The strongest African currencies demonstrate resilience as global markets navigate inflationary pressures, geopolitical tensions, and shifting monetary policies. While the continent’s economic landscape remains diverse—from resource-dependent economies to emerging tech hubs—certain currencies have consistently outperformed their peers, maintaining more substantial exchange rates against the US dollar.

Contents

- 1. Tunisian Dinar (TND): Africa’s powerhouse currency

- 2. Libyan Dinar (LYD): Backed by oil reserves

- 3. Moroccan Dirham (MAD): A Steady Performer

- 4. Botswana Pula (BWP): A model of stability

- 5. Seychellois Rupee (SCR): The island economy’s strength

- 6. Ghanaian Cedi (GHS): A Currency on the Rebound

- 7. Eritrean Nakfa (ERN): Fixed but Stable

- 8. South African Rand (ZAR): Africa’s Most Traded Currency

- 9. Namibian Dollar (NAD): Pegged to the Rand

- 10. Lesotho Loti (LSL): Another Rand-Pegged Currency

- The Bigger Picture: Challenges and Opportunities

1. Tunisian Dinar (TND): Africa’s powerhouse currency

At the helm of Africa’s currency rankings is the Tunisian Dinar (TND), the continent’s most valuable currency. Trading at approximately 3.11 to the US dollar, the TND benefits from Tunisia’s robust trade ties with Europe, controlled foreign exchange policies, and a relatively stable economy. Despite economic challenges such as inflation and slow growth, Tunisia’s government maintains strict capital controls, preventing excessive currency fluctuations.

2. Libyan Dinar (LYD): Backed by oil reserves

The Libyan Dinar (LYD) remains a strong contender, exchanging at around 4.82 LYD per US dollar. Libya’s vast oil reserves underpin the currency’s value, though ongoing political instability poses risks. The country’s central bank maintains an artificially high exchange rate, supported by oil revenues and stringent currency controls. However, fluctuations in global oil prices and internal governance challenges leave the LYD vulnerable to sudden shifts.

3. Moroccan Dirham (MAD): A Steady Performer

The Moroccan Dirham (MAD) is one of Africa’s most stable currencies, trading 9.91 to the US dollar. Morocco’s diversified economy—anchored in tourism, agriculture, and manufacturing—supports the Dirham’s stability. Unlike many African nations, Morocco has pursued a managed exchange rate regime and is gradually introducing more flexibility. The country’s close economic ties with the European Union also bolster investor confidence in the MAD.

4. Botswana Pula (BWP): A model of stability

The Botswana Pula (BWP), valued at 13.50 per US dollar, is widely regarded as one of Africa’s most stable currencies. The country’s conservative monetary policies, substantial foreign exchange reserves, and diamond-led economy contribute to the Pula’s resilience. Unlike many resource-rich nations, Botswana has successfully avoided the pitfalls of the “resource curse,” maintaining steady economic growth and sound fiscal management.

5. Seychellois Rupee (SCR): The island economy’s strength

With a 13.64 per US dollar valuation, the Seychellois Rupee (SCR) benefits from the country’s thriving tourism sector. Seychelles, a small but high-income island nation, has strategically leveraged its natural beauty to attract foreign investment. The government’s prudent fiscal policies and relatively low debt levels have allowed the SCR to remain one of Africa’s strongest currencies despite the economy’s dependence on external factors such as global travel trends.

6. Ghanaian Cedi (GHS): A Currency on the Rebound

The Ghanaian Cedi (GHS), currently trading at 14.25 per US dollar, has recently faced volatility. Ghana’s economy, heavily reliant on cocoa, gold, and oil exports, has experienced inflationary pressures and external debt concerns. However, recent IMF interventions and fiscal tightening measures have helped stabilize the Cedi. The government’s commitment to structural reforms and reducing external borrowing could strengthen the currency in the coming years.

7. Eritrean Nakfa (ERN): Fixed but Stable

At a fixed rate of 15.00 per US dollar, the country’s government tightly controls the Eritrean Nakfa (ERN). Eritrea’s economy remains highly centralized, with limited foreign exchange transactions permitted. While this policy has helped maintain stability, it has also restricted economic growth and foreign investment. The currency’s strength is mainly artificial, reflecting government-imposed controls rather than free market forces.

8. South African Rand (ZAR): Africa’s Most Traded Currency

The South African Rand (ZAR), trading at 18.13 per US dollar, remains the continent’s most widely traded currency. South Africa’s deep financial markets, well-developed banking system, and status as a regional economic powerhouse contribute to the Rand’s prominence. However, high inflation, fiscal deficits, and political uncertainties continue to weigh on the currency. The Rand’s volatility is closely linked to global commodity prices and investor sentiment towards emerging markets.

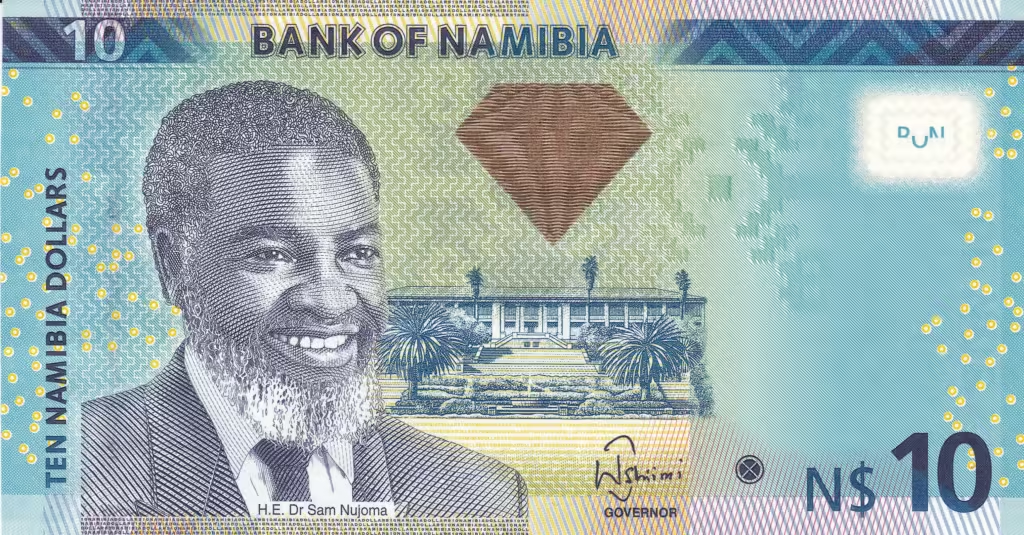

9. Namibian Dollar (NAD): Pegged to the Rand

The Namibian Dollar (NAD), exchanging at 18.23 per US dollar, is pegged to the South African Rand, mirroring its fluctuations. Namibia benefits from stable governance, a mining-driven economy, and prudent fiscal management. However, the currency’s dependence on the Rand means it is susceptible to external shocks affecting South Africa’s economy.

10. Lesotho Loti (LSL): Another Rand-Pegged Currency

Like the Namibian Dollar, the Lesotho Loti (LSL) is also pegged to the South African Rand at 18.23 per US dollar. Lesotho’s economy highly depends on South Africa for trade, remittances, and economic stability. While the peg ensures stability, it limits Lesotho’s monetary policy flexibility, making it vulnerable to South Africa’s economic cycles.

The Bigger Picture: Challenges and Opportunities

Economic policies, natural resources, and external influences shape Africa’s strongest currencies. Countries with tightly managed exchange rate regimes, such as Tunisia and Libya, have maintained stronger currencies, though sometimes at the cost of market flexibility. Meanwhile, nations with free-floating currencies, like South Africa and Ghana, experience more volatility but also have the potential for long-term appreciation based on economic reforms.

These currencies are not immune to global and domestic pressures despite their strength. Inflation, political instability, and external debt continue to pose risks. However, nations that pursue sound fiscal policies, diversify their economies, and maintain investor confidence are more likely to see their currencies remain resilient.

As Africa’s economic landscape evolves, the performance of these currencies will be a key indicator of stability and growth across the continent. Investors and policymakers will closely watch how these economies navigate global economic shifts in the years ahead.