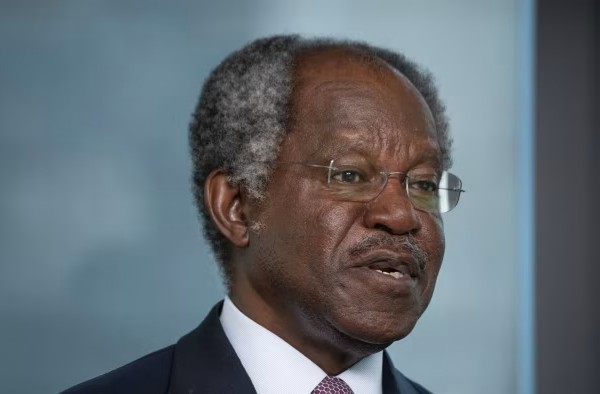

Until last week, the name Adebayo Ogunlesi could not ring a bell in the ears of many in Africa.

But the BlackRock deal to buy the $100 billion investment management firm he co-founded and heads, Global Infrastructure Partners (GIP), now adds to the many achievements the 70-year-old Nigerian has to his name.

The deal has increased the billionaire’s public profile; seemingly, he has been avoiding going by the portfolio held by GIP.

The $12.6 billion deal announced on Friday is set to make him a dollar billionaire with a seat on the board of the world’s largest money manager.

The deal is BlackRock’s largest acquisition since 2019, and experts posit it underscores renewed investors’ interest in digital infrastructure, transportation, and energy.

According to disclosures, the American firm will pay $3 billion and an estimated 12 million shares valued at $9.5 billion in the deal. The deal is expected to be closed by the third quarter of 2024.

Ogunlesi thanks his wife for a career move culminating in one of the largest financial transactions in a decade.

“Either you decide you like your job and you want to keep doing it. Or, if you decide you don’t, find something else. But please don’t think you can spend the next five years moaning,” he told Financial Times in an interview.

Who is Ogunlesi?

He was born and raised in Lagos, Nigeria, to a medical professor. He earned a first-class undergraduate from Oxford University and business and law degrees from Harvard.

He started his career at Cravath, Swaine & Moore before moving to First Boston, which at the time was big in mergers and acquisitions in the 1980s.

He rose through the company ranks even more after Credit Suisse acquired the firm. In 2002, Ogulensi was made the head of the firm’s investment banking division.

His wife’s push following complaints about work pushed him to launch the next phase of his career in investment management, birthing GIP.

Bayo, as he is popularly known by his elite friends, teamed up with Matt Harris, who was the head of the energy group at the time, and came up with the idea of an infrastructure investments manager.

The success of GIP has been thanks to the connections that Ogunlesi forged while working at Credit Suisse.

Together with Harris, they tapped the head of General Electric infrastructure business, Bill Woodburn, and Credit Suisse ex-partners, including Michael McGhee, Raj Rao, and Jonathan Bram.

They raised over $5 billion at the launch of GIP in 2006, including $1 billion in banking from Credit Suisse and $ 500 million from General Electric.

Their first significant investment was a stake in London City Airport.

The stars were aligned!

After 17 years in operations, the company has accumulated over $100bn in assets, leading in a sector valued at more than $1tn.

The Bloomberg Billionaires Index estimates that Ogunlesi owns 17.5 percent stakes in GIP. If the $12.5 billion sale price is split equally among the other 27 founding partners, each will get a $380 million stake.

Career-long connections

Ogunlesi is also a lead independent director at investment bank Goldman Sachs, a position he has held since 2014 but now will relinquish following last week’s deal. He also serves on other boards and has been tapped by the US government for his business acumen.

In 2016, former US President Donald Trump appointed him to head the President’s Strategic and Policy Forum. Under Biden, he has been appointed to head the National Infrastructure Advisory Council.

GIP’s growing infrastructure and transport investment portfolio includes Edinburgh and Sydney airports, Melbourne Port, and CyrusOne data centers. Others include pipelines in the US and Italo speed rail.

The company and its subsidiaries have combined annual revenues of about $75 billion. It employs an estimated 115,000 people.