On August 23, it emerged that Safaricom, the biggest telco in Kenya and the most profitable company, requested the Communication Authority (CA) to regulate satellite network operators like Starlink operating in the country.

In its memo to the sector regulator, Safaricom said that satellite ISPs should not be granted a license directly without a partnership with a local licensee. It also requested the CA to carefully assess the risks of granting such firms authorization.

These demands show a resolve by Safaricom to dominate the broadband market, by jeopardizing the efforts of cheaper, inclusive and universal access to Internet. While Satellite Internet is always expensive, new Low Earth Orbit (LEO) operators have experimented and are now operating in the traditionally challenging African market where predecessors in western world such as Iridium and Globalstar failed in.

The cost of user terminal (UTs), installation and monthly subscriptions have been the biggest barriers to adopting satellite Internet. However, LEO operator Starlink, has reduced its UTs from $695 (KES89,000) to $350 (KES45,500) in less than three months while also providing flexible data plans and rental options to reduce monthly costs.

These are efforts that should be lauded as a way of providing cheaper Internet and achieving last mile connectivity. More importantly, users have recorded higher speeds (50 – 200 Mbps) compared to those provided by Safaricom (10 -100 Mbps) at a higher price ($23 – $93).

Being a key player in the country for over two decades, Safaricom should be aware that pricing and coverage is key to winning customers in Kenya’s broadband market. In their annual report, Safaricom has indicated that they have achieved over 80% mobile coverage in the country.

Despite excellent coverage, mobile and fixed broadband costs are still unaffordable in remote, rural and urban areas, thanks to failing business models coupled by low average revenue per user.

LEO operators such as Starlink provides an alternative for cheaper and faster Internet for such regions that are uneconomically viable to be connected by terrestrial systems such as mobile and fixed fiber. This is in line with global aspirations of realizing broadband through satellites in some rural and remote areas.

Ironically, in the letter, Safaricom states that granting license to operators like Starlink has associated risks and harm to Kenyans. Being a technology company with milestone success in mobile money, Safaricom should at least appreciate the role of satellite technology in development instead of providing vague and dishonest statements about “risks” and “harm”.

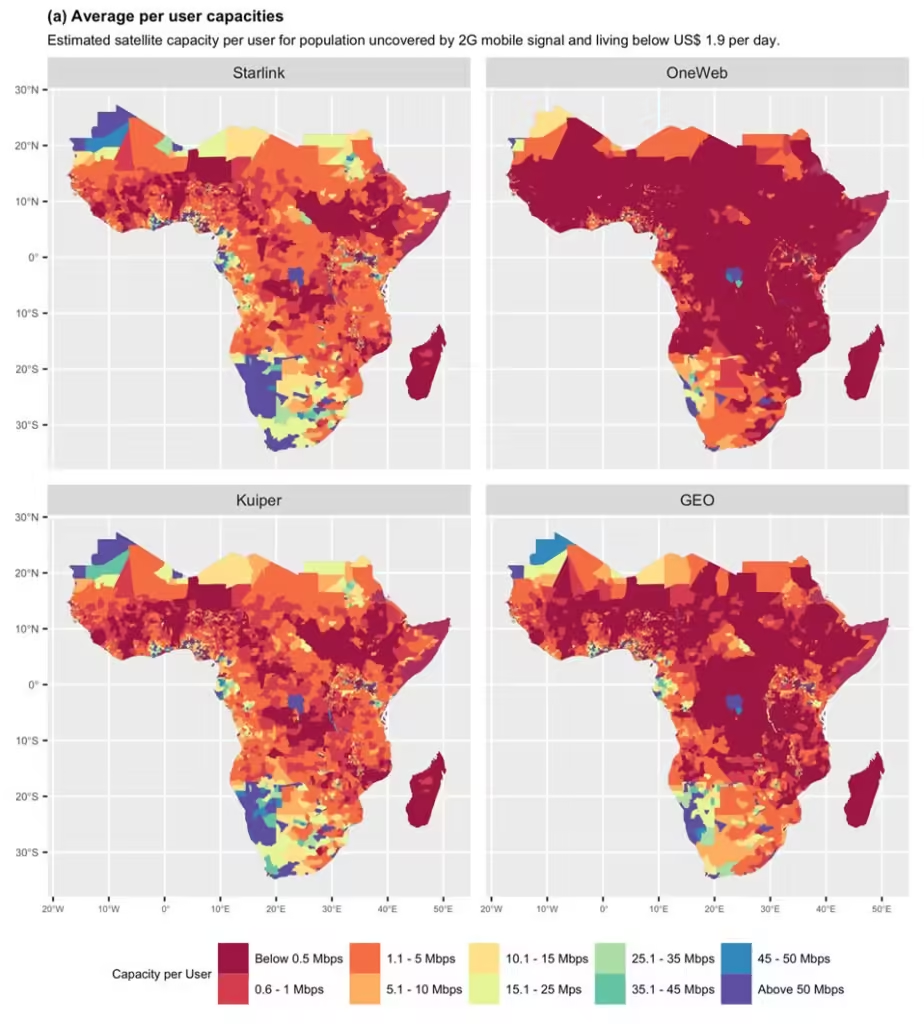

Low Earth Orbit satellite broadband providers such as Starlink, OneWeb and Kuiper will be key to providing higher Internet speeds for Africa’s remote and rural areas

Low Earth Orbit satellite broadband providers such as Starlink, OneWeb and Kuiper will be key to providing higher Internet speeds for Africa’s remote and rural areas

In last parts of the memo, Safaricom indicates that it has partnered with AST to provide space to mobile services. The statement indicates that Safaricom does not have a problem with satellite broadband providers as long as they partner with them in providing services. In short, Safaricom’s priority are their business partnerships and sale agreements but not service to the user.

While such partnerships are useful in realizing universal broadband access, nothing stops Safaricom from forging ahead with such programs while leaving stand-alone operators to provide services to Kenyans.

As a matter of fact, satellite broadband providers have been in Kenya in the last 3 decades. Moreover, other LEO operators such as Eutelsat-OneWeb have resale agreements and partnerships to provide broadband through Business-to-Business (B2B) strategy.

Providing Internet through Business-to-Consumer (B2C) strategy is currently implemented by Starlink to effectively reduced the cost of satellite broadband.

Indeed, continental reports such as the 2021 Asia Development Bank (ADB) report (page 28-29) has outlined flexible and streamlined licensing procedures, reduced taxation and tariffs as means of reducing LEO satellite broadband costs.

Adding Mobile Network Operators to the supply chain of satellite broadband will increase the prices of Internet beyond the affordable rates that Kenyans are currently enjoying.

Like Starlink that entered the Kenyan market with high installation costs and monthly subscriptions but quickly learned, Safaricom should borrow key lessons and lower its appetite for profit and dominance.

Our lab results shows that Starlink with an estimated total cost of ownership of US$ 4.2±0.5 billion and operating 4,425 satellites is still able to provide 40±24 Mbps at US$30±5 per subscriber.

Nothing stops Safaricom to lower it broadband prices to compete fairly with LEO satellite broadband operators such as Starlink.

Osoro is Doctoral Candidate in Earth Systems and Geoinformation Science