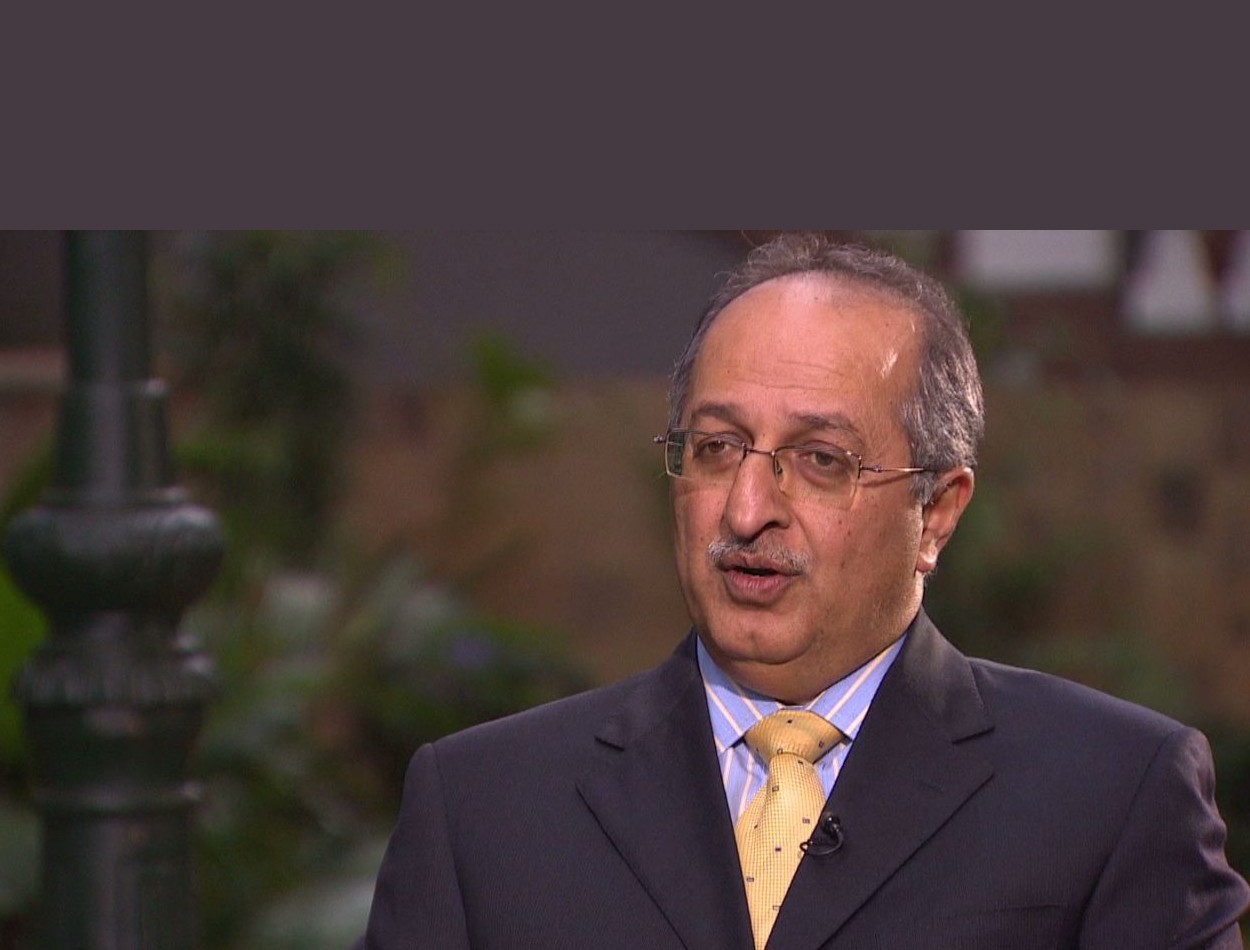

To Kenyans, he is a billionaire businessman and philanthropist who has done a lot to uplift thousands of young people from the chokehold of poverty.

But to Africa and the world, he is a respected banker who has revolutionized the banking industry in East and Central Africa.

“Mwangi wa Equity” as he is fondly referred to in Kenya considers himself a village boy from Kangema, on the slopes of Aberdare Ranges in the Mt Kenya region of Kenya.

From media interviews he’s often referred to as the chief executive of the most profitable bank in Kenya, and he has painted the picture of someone who rose from humble beginnings to conquer the world.

Insiders describe him as someone who walks with the humility instilled in him from an early age and believes it is a guiding principle to most of his decisions.

Critics, on the other hand, believe that he was one of the biggest beneficiaries of Kenya’s former President Mwai Kibaki’s rule, which saw economic reforms that opened up banking to millions of unbanked Kenyans but also strengthened select commercial banks.

Equity Bank, with a presence in six countries, has increased access to financial services in the region.

Doubters, especially in its first market of Kenya, have accused the bank and its founders of aggressive and predatory techniques which saw businesses and households lose property after loan defaults.

Contents

Who is James Mwangi?

His journey begins in 1962, born into a family of seven children and raised by a single mother.

He lost his father to the Mau Mau war on the colonial government that gave way for independence.

For the most part of his childhood, he would sell fruits, charcoal and indulge in small business activities just to help with the bills around the house.

Maybe this was the starting point to building and leading one of the biggest business empires in the region.

James Mwangi attended Nyagatugo Primary before joining Ichaguli Secondary for his O levels and later went to Kagumo High School for the A levels.

His upbringing instilled in him a strong work ethic and determination to succeed.

Mwangi holds a Bachelor of Commerce degree (Accounting option) from the University of Nairobi. He is also a Certified Public Accountant (CPA).

Additionally, he has undertaken executive education programs at various institutions, including the Wharton School of the University of Pennsylvania and the Harvard Business School.

Starting off

After completing his university education, he secured his first job as an auditor at PricewaterhouseCoopers (PwC).

Three years later, he transitioned to Ernst & Young, where he continued his work as an auditor.

From Ernst & Young, Mwangi worked at Trade Bank before joining Equity Building Society in 1991, having been head hunted by the then CEO, Mr. John Mwangi.

At the time, Equity Building Society was a fledgling organization just beginning to establish itself in Murang’a, a town near Kenya’s capital city, Nairobi.

By 1993, Equity Building Society was on the verge of collapse, facing significant financial losses estimated at around Ksh5 million annually about $58,000 with current exchange rates.

During this critical period, the CEO, John Mwangi, and Chairman, Peter Munga, turned to James Mwangi to oversee the winding down of operations.

Despite their efforts throughout the year, the institution showed no signs of improvement, languishing at the bottom of the financial sector rankings.

However, James Mwangi was unwilling to let go of this entrepreneurial opportunity. He requested the chance to implement new strategies and oversee the society’s operations.

He believed in the importance of exploring alternative approaches before giving up entirely.

Perhaps by reevaluating strategies, making personnel changes, or adopting innovative methods, the business could be revitalized.

Given the opportunity to serve as the Strategist & Financial Director, James Mwangi embarked on a new direction for Equity Building Society.

He aimed to revolutionize the institution by promoting microcredit opportunities for small business owners through the introduction of low-cost accounts, a novel strategy in Kenya’s banking landscape at the time.

Mwangi recognized the potential of microcredits to promote financial inclusivity among Kenyans.

From a building co-operative society, to a behemoth of a bank

During this period, many small business owners in Kenya had limited involvement with traditional banking services, which primarily catered to corporate clientele.

Drawing from personal experiences, including observing his mother saving money under the mattress, Mwangi sought to attract individuals like her to entrust their savings with Equity Building Society.

Furthermore, Mwangi prioritized customer care initiatives, emphasizing the importance of treating customers with respect and providing exceptional service.

With a growing customer base of 27,000 individuals, he emphasized the significance of making customers feel valued and appreciated.

Recognizing the importance of employee engagement, Mwangi encouraged Equity Building Society’s 27 employees to invest 25 percent of their salaries into company shares.

This not only aligned their interests with the institution’s success but also provided a tangible incentive for their commitment and dedication.

Additionally, he instituted raises for employees, motivating them with long-overdue financial rewards.

Encouraging staff to advocate for Equity Building Society, Mwangi galvanized employee support for the institution’s vision and mission.

Through their efforts, word spread, attracting new customers and bolstering the institution’s reputation in the market.

These innovative strategies proved transformative for Equity Building Society, enabling it to surpass established banks like Barclays (now Absa) and Standard Chartered in market share.

By 1997, the institution began to turn a profit, experiencing growth in both customer base and financial stability.

In 2000, Mwangi pursued further expansion by embracing digital banking techniques, inspired by successful implementations in developed countries.

By leveraging online banking platforms, he aimed to enhance accessibility and streamline customer service.

Institutional support and favourable state policies

Securing capital from sources such as the European Union and investment firms like IFC, CDC, and OPIC, Mwangi spearheaded Equity’s transition into digital banking, significantly modernizing its operations.

In 2004, Equity Bank was officially established under Mwangi’s leadership as CEO. Through strategic partnerships and private placements, the institution secured the necessary funding for expansion, solidifying its position in the banking sector.

Mwangi’s visionary leadership received support from various organizations, including The Mt. Kenya Foundation, which provided invaluable guidance and assistance in decision-making processes.

Additionally, favorable economic policies implemented under President Mwai Kibaki’s administration facilitated Equity’s growth and success.

By 2011, Equity Bank had achieved remarkable milestones, registering profits of approximately Kshs.12 billion ($140 million) and expanding its operations into multiple countries across East Africa.

With over 500 branches in nations like DRC, Tanzania, Rwanda, Uganda, and even South Sudan, Equity Bank has emerged as a leading financial institution in the region.

Wings to fly scholarship program

However, Mwangi’s ambitions extended beyond financial success.

Recognizing the importance of corporate social responsibility, he established Equity Group Foundation’s Wings to Fly, a program dedicated to sponsoring underprivileged students’ education.

To date, the organization has supported over 21,000 students, embodying Equity’s commitment to giving back to society.

Today, Equity Bank boasts the largest customer base in East and Central Africa, recording substantial profits and solidifying its position as one of the world’s strongest banking brands.

From its humble beginnings with 27,000 customers, Equity has risen to prominence, achieving a remarkable turnaround from its struggles in the nineties under Mwangi’s strategic leadership.

While Mwangi is widely celebrated for his professional achievements, he remains grounded as a devoted family man, blessed with four sons.

He attributes his success to the values instilled by his mother, whose resilience continues to inspire him.

Mwangi’s contributions to entrepreneurship have been recognized through numerous awards, including the prestigious Ernst & Young World Entrepreneur of the Year Award.

His journey serves as a testament to the transformative power of perseverance and strategic innovation, inspiring entrepreneurs to embrace second chances and pursue their visions with unwavering determination.