I recently recommended Money Heist to my father. Yes, the old man retired and he was looking for things to watch to pass the time.

Before you judge me, he didn’t want a book. He wanted something that had a brilliant mind.

Anyway, after the first two seasons, he called me and was like you know this story is familiar (I almost thought he was organizing a heist for the family)

However, he started telling me this story that happened in the 90’s in Kenya.

A story about a mastermind con artist called Pattni that he would loosely compare to Money Heist’s Professor.

Contents

Who is Pattni?

Kamlesh Pattni was born in 1965 to a businessman in the Kibokoni area of Mombasa, a coastal city in Kenya.

For the better part of his childhood, he helped his father in his businesses up until he left for Nairobi, Kenya’s capital city in his early twenties.

He came to Nairobi to create an opportunity for himself and joined his brother in running a small jewelry shop that sold gold and silver ornaments.

He once said that gold had always fascinated him and since childhood, being a Gold Trader was his ultimate vocation.

It began with chance meeting

At just 24 years old, he pitched his revolutionary business idea to Kenya’s Director of Intelligence, Mr. James Kanyotu, having bumped into him at an upmarket suit shop in Nairobi, where they were introduced to each other by Mr. Veljibhai Ganni, a mutual acquaintance.

Pattni would inform James that there was so much gold flowing through Kenya into the global markets with little to no benefit to the Kenyan government it’s equally just smuggled out.

Much of the gold was coming in from mineral-rich Zaire (now the Democratic Republic of Congo) with the rest generated by village miners in Western Kenya.

From Kenya, the gold was smuggled out to Europe, India, and Dubai mainly through Kenya’s biggest airport, Jomo Kenyatta International Airport.

Kamlesh Pattni convinced the intelligence chief that with the right licenses, he would operate an above-board gold export operation that had the potential to generate US$50 million in foreign exchange earnings per annum.

James Kanyotu would soon secure a sit-down between Pattni and the then-president of Kenya, Daniel Arap Moi who was excited by the prospects of foreign currency flowing into the country at a time when his government was in serious economic distress.

In the early 1990s, Kenya was in dire need of foreign currency following stringent structural adjustment programs introduced by the World Bank and International Monetary Fund that devalued the Kenya Shillings and depleted the government’s foreign reserves.

One of the economic policies introduced to bolster foreign currency inflows was the export compensation scheme to promote non-traditional exports such as minerals that were exported through Kenya.

The compensation scheme would subsidize exporters at 20% of their foreign earnings. Exporters would present their paperwork and receive compensation directly from the Central Bank of Kenya.

Gold smuggling from Zaire

Following President Moi’s directive, Kamlesh Pattni was granted an exclusive license to export gold and diamonds from Kenya.

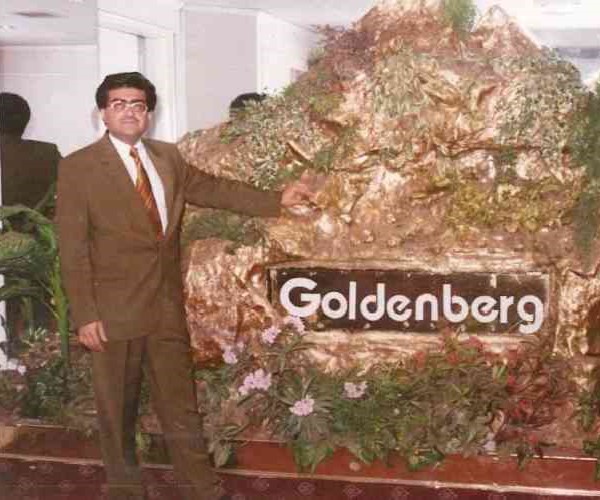

He partnered with intelligence chief, James Kanyotu to start Goldenberg International Limited.

Goldenberg would smuggle gold from Zaire, flying cargo in small planes into Wilson Airport, Nairobi, and exporting the same to international markets as ‘Kenya’s’ gold.

So powerful was Pattni that on one occasion when a senior customs officer seized his gold at Wilson Airport based on false declaration forms, Pattni made one phone call and the government machinery led by the Intelligence Chief, Commissioner of Customs, Criminal Investigative Department (CID) Director all made calls directing that the cargo be released, albeit irregularly.

When the senior customs officer hesitated, the Commissioner of Mines and Geology personally drove to Wilson Airport in the dead of the night to authorize the release of Pattni’s cargo.

Pattni would also use this influence to secure a higher percentage on his claims for export compensation.

While other exporters were getting 20%, his claims attracted a special rate of 35%.

Fake compensation claims

Soon Pattni would stop struggling to smuggle gold from Zaire.

With fake export documents and proof of receipt of foreign earnings, he claimed the 35% compensation.

Through bribery, customs officials would certify the export documents.

As for foreign receipts on exports he would send money to his own entities abroad and wire it back as proceeds of gold export.

For every $1 million of fake claims lodged, Goldenberg International would walk away with $350,000 without the hustle of exporting anything.

The generation of fake compensation claims became the cornerstone of his scheme, and when banks started pointing out the anomaly, Pattni called upon his partner James Kanyotu and they formed their own bank, Exchange Bank Ltd.

Whistleblower

The scandal, which came to be known as the Goldenberg Scandal was exposed in 1993 when a patriotic whistleblower, Mr. David Munyakei shared copies of the compensation documents with Opposition MPs Prof. Anyang’ Nyong’o and Paul Muite who tabled them in Parliament.

David Munyakei was at the time a junior officer at the Central Bank of Kenya who was involved in the processing of compensation claims and couldn’t make sense of the billions worth of exports in gold and diamonds that the documents claimed.

By the time the dust settled on the scandal, Kenya had lost over US$ 600 million (about 10% of the country’s 1993 GDP) in fake compensation claims.

Following public uproar and pressure from the international community, Pattni was briefly arrested but little action was taken on the scandal until President Moi retired.

In 2003, Moi’s successor President Mwai Kibaki formed a commission of inquiry which resulted in Pattni facing several Goldenberg-related charges in Kenyan courts.

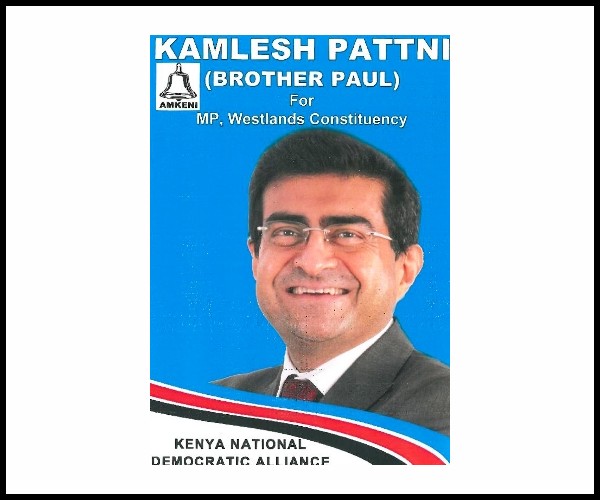

After a decade in court corridors and influence peddling, Kamlesh Pattni walked away a free man, started a church, became a pastor, and even vied for a Member of Parliament seat before setting eyes on his next victim; Zimbabwe.

‘Savior’ to Zimbabwe’s economic woes

From 2001, Zimbabwe has faced tough economic sanctions imposed by the USA, the EU, and the UK over human rights abuses that make it difficult for it to freely transact in dollars inside the international financial system.

To attract foreign currency, Zimbabwe’s government crafted a scheme akin to Kamlesh Pattni’s activities in 1990s Kenya.

And once again, Pattni was at the center of it.

Up until 2023, when an Al Jazeera expose blew the lid on Pattni’s activities in Zimbabwe, he was a very powerful man with Zimbabwe’s President, Emmerson Mnangagwa at his beck and call.

In a program sanctioned by the government, Pattni would smuggle Zimbabwean gold to Dubai, refine and rebrand it as Dubai gold, sell it in the international market, and send the proceeds back to Zimbabwe, providing the Reserve Bank of Zimbabwe with the much needed foreign currency.

His company, Susan General Trading had licenses from both the Central Bank of Dubai and the Reserve Bank of Zimbabwe that allowed its agents to carry suitcases full of gold one way to Dubai and US dollars the other way to Zimbabwe.

Same scam, 30 years apart

In a mirroring scheme to Kenya’s 1990s export compensation scheme, Pattni was paid 18% commission for all the US dollars he brought into the country.

A report by the Reserve Bank of Zimbabwe identifies his company, Susan General Trading as one of the biggest foreign exchange earners for the country in the year 2020.

But in a scam typical to Kenya’s Goldenberg, Pattni was bringing back very little foreign currency to Zimbabwe. He was faking paperwork, bribing customs and reserve bank officials to approve them, and making away with the 18% commission.

In the same scam, 30 years apart, Kenya and Zimbabwe lost hundreds of millions of dollars to the same man.

In the Al Jazeera investigative piece, Gold Mafia, Pattni bragging to have saved Zimbawe’s economy from collapsing, offered to launder $100 million for reporters pretending to be Chinese criminals using the same machinery that he had going.

While Kenya and Zimbabwe are his best-known victims, Pattni’s web of Dubai-based gold-trading companies operate in many African countries including; Zambia, Malawi, Democratic Republic of Congo, Tanzania, and Uganda.

Whether Kamlesh Pattni, now a Dubai-based businessman will mastermind a scam of similar magnitude in yet another African country remains to be seen.