Let’s be honest—2025 isn’t looking like a walk in the park for many African economies. Countries like Kenya, Nigeria, and South Africa deal with inflation, shaky currencies, and rising living costs. It’s tough out there. But even when the economy feels like it’s working against you, there are ways to protect your money, grow your savings, and keep your head above water. Here are some practical, everyday money tips to help you navigate the financial challenges of 2025.

Contents

1. Don’t put all your eggs in one basket

If there’s one thing you should take away, it’s this: don’t rely on just one source of income. Jobs can disappear, businesses slow down, and prices rise overnight. Having multiple ways to make money can give you a safety net.

- Side Hustles: Think about what you’re good at and find a way to monetize it. Maybe you’re great at baking, fixing things, or even social media. Turn those skills into a side gig.

- Farming: If you have a bit of land, consider growing your food. Not only will you save money, but you can also sell the extra to make some cash.

- Online Work: The internet offers a whole lot of opportunities. From freelancing to selling products online, there are ways to earn money without leaving your house.

The goal here is to spread your risk. If one income stream dries up, you’ve got others to fall back on.

2. Invest in things that last

When the value of money is dropping (thanks, inflation!), it’s wise to put your cash into things that hold their value over time.

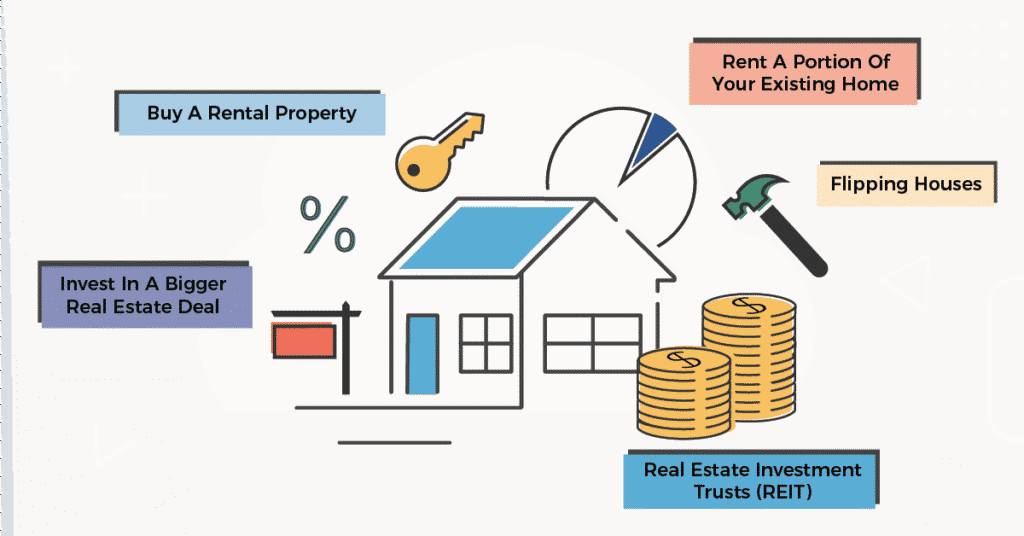

- Land and Property: Real estate is a classic. Even if the economy is struggling, land and houses tend to grow in value over the long term. If buying property feels out of reach, consider joining a savings group or cooperative to pool resources.

- Gold and Silver: These precious metals have been a safe bet for centuries. You don’t need to buy gold bars—some apps and platforms let you invest small amounts.

- Livestock or Farming: In rural areas, owning cows, goats, or chickens can be a solid investment. They provide food, can be sold for cash, and often increase in value.

These investments can protect your money from losing value and give you something to fall back on if times get tough.

3. Use technology to your advantage

Africa’s fintech boom is among the few bright spots in the economy. So many tools are out there to help you save, invest, and manage your money better.

- Mobile Money: Apps like M-Pesa (Kenya) and Paga (Nigeria) make sending, saving, and borrowing easy. Use them to avoid high bank fees and keep your cash secure.

- Investment Apps: Platforms like Cowrywise (Nigeria) and EasyEquities (South Africa) let you invest in stocks, bonds, and mutual funds with small amounts of money. It’s a great way to grow your savings over time.

- Cryptocurrency: This one’s risky, but if you’re curious, start small. Bitcoin and Ethereum are the most popular but understand what you’re getting into before diving in.

Just remember: not every shiny new app is trustworthy. Do your research and stick to reputable platforms.

4. Build an emergency fund

Life is full of surprises and not the good kind. A medical emergency, a job loss, or even a broken-down car can throw your finances into chaos. That’s why having an emergency fund is so important.

- Start Small: If saving feels impossible, start with whatever you can. Even saving 5% of your monthly income can add up over time.

- Cut Back Where You Can: Look at your spending and see where you can trim. Maybe it’s eating out less, canceling a subscription you don’t use, or switching to a cheaper phone plan.

- Keep It Accessible: Your emergency fund should be easily accessible when needed. A savings account or mobile money wallet is a good place to keep it.

Even a small cushion can make a huge difference when life throws you a curveball.

5. Stay in the know

The economy constantly changes, and staying informed can help you make smarter money decisions.

- Follow the News: Watch what’s happening in your country and globally. Understanding inflation, interest rates, and government policies can help you plan.

- Talk to People: Join online groups, attend community meetings, or chat with friends who are good with money. Learning from others can give you new ideas and perspectives.

- Be Ready to Adapt: If your job or business isn’t working out, don’t be afraid to try something new. The ability to pivot is one of the most valuable skills you can have.

6. Learn new skills

In a tough economy, the more skills you have, the better your chances of finding work or starting a side hustle.

- Online Courses: Platforms like Coursera and Udemy offer affordable courses in everything from coding to graphic design.

- Vocational Training: Skills like plumbing, carpentry, or tailoring are always in demand and can provide a steady income.

- Business Skills: If you’re running a small business, learning about marketing, budgeting, or customer service can help you grow and stay competitive.

Investing in yourself is one of the best ways to future-proof your income.

7. Be smart about debt

Debt can be a trap, especially when interest rates are high. If you’re going to borrow, do it carefully.

- Avoid High-Interest Loans: Payday loans and some microloans can have crazy high interest rates. If you need to borrow, look for cheaper options, like cooperative societies or digital lenders with clear terms.

- Pay Off What You Owe: If you already have debt, focus on paying it down. Start with the debts that have the highest interest rates.

- Only Borrow for Growth: If you’re taking a loan to start a business or invest in something that will make you money, ensure the returns will be worth it.

8. Think long-term

It’s easy to get caught up in the day-to-day struggles, but keeping an eye on the future can help you stay focused.

- Save for Retirement: Start saving for your retirement now, even if it’s just a tiny amount. The earlier you start, the more time your money has to grow.

- Invest in Health: Medical bills can wipe out your savings. If you can, get health insurance or join a community health fund.

- Plan for Your Family: Whether buying land, starting a business, or saving for your kids’ education, consider how your decisions today will impact your family’s future.

You’ve got this

Times are tough, but they won’t last forever. By making smart choices highlighted in the money tips provided today—diversifying your income, saving for emergencies, or learning new skills—you can build a stronger financial future for yourself and your family.

Remember, it’s not about how much money you have right now. It’s about how you manage, grow, and protect it. And most importantly, it’s about staying resilient. Tough times don’t last, but tough people do. In 2025 and beyond, your financial success will depend on the choices you make and the mindset you bring to the table.

So take a deep breath, make a plan, and keep moving forward. You’ve got this.