Online fraud in Africa is on the rise, with fraudsters constantly coming up with new tactics to scam unsuspecting victims out of their hard-earned money.

According to Interpol’s ‘African Cyberthreat Assessment Report’ released in 2023, the landscape of cybercrime has changed drastically with the emergence of new technologies.

“Cybercrime today is a far cry from what it used to be; there are now more sophisticated attack vectors such as distributed denial-of-service (DDoS) attacks, phishing attempts, malware campaigns, ransomware attacks, and other malicious activities that can cause a great deal of harm and have a serious impact on organizations and communities,”

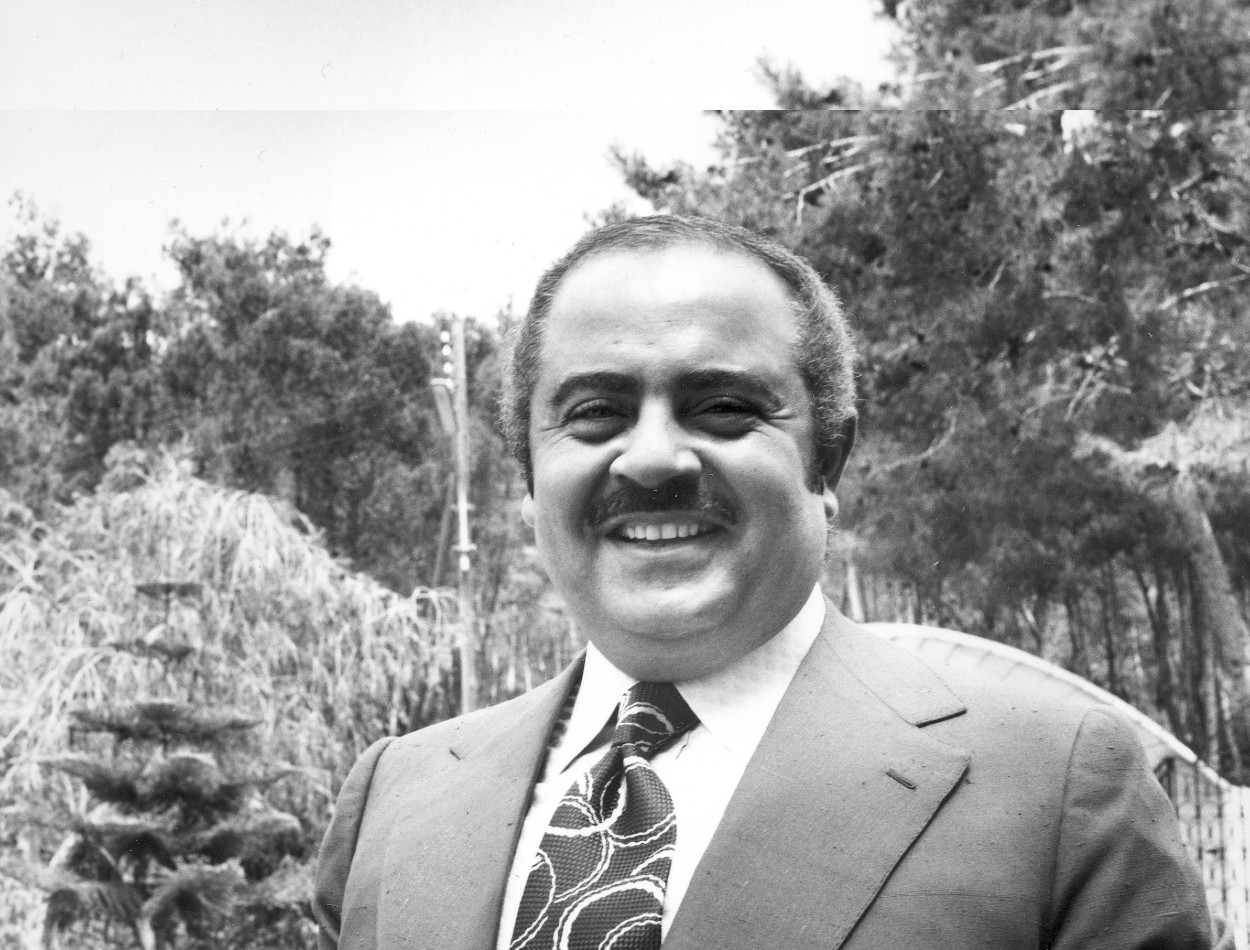

Craig Jones – Director of Cybercrime Directorate at INTERPOL

The following are the most common scams in Africa;

Contents

1. Phishing

Phishing is a type of cyber-attack where fraudsters try to steal important information like usernames, passwords, and credit card details from unsuspecting individuals.

They often send fake emails or create fake websites that look real to trick people into giving away their personal information. Fraudsters would then use the data obtained to make money by; selling on the dark web, extortion, or other cybercrime-related activities.

The increasing reliance on online services and applications in Africa has made people more susceptible to phishing attacks. It’s crucial to be aware of the risks and take necessary precautions to safeguard our personal information.

2. Business Email Compromise (BEC) campaigns

Business Email Compromise is a type of cyberattack where hackers manage to get into a company’s email account system and send fake emails to its partners or clients.

The deceitful emails usually have harmful links or attachments that, if opened, can infect the recipient’s device with harmful software or let the attacker get hold of sensitive data.

The emails in certain cases impersonate someone known to the victim and create a sense of urgency or panic that requires the victim to attend to a request without verifying the sender’s authenticity.

The continent of Africa accounts for just 1 percent of the global BEC attempts with South Africa being the most targeted African country, accounting for almost 50 percent of these attempts.

3. Ransomware

Ransomware is a malicious kind of software that locks people out of their own data or systems by encrypting their files. Once everything is locked up tight, the poor victims get a message saying they have to cough up some cash (usually in Bitcoin or some other digital money) if they want their files back.

This attack has become super popular with cybercriminals because it’s an easy way to make a ton of money without breaking a sweat. Sometimes, all it takes is one email to pull off a successful ransomware attack.

But watch out, because this sneaky software can also sneak its way onto your computer through sketchy ads on websites and social media, or by tricking you into downloading something bad.

4. Banking Trojans and Stealers

Banking Trojans and Stealers are malicious programs that steal sensitive information such as usernames, passwords, and financial data.

The trojans can infiltrate your computer through phishing emails, shady websites, or drive-by downloads. Once in, they break into your online banking accounts, whether it’s by capturing your keystrokes or swiping your login credentials.

They can even play tricks on your browser, redirecting your money transfers to the fraudsters’ accounts instead of the intended accounts. To make matters worse, Banking Trojans often team up with other malware like Spyware and Rootkits to spread like wildfire across networks and systems.

These Trojans have evolved over time, using advanced techniques like man-in-the-browser attacks to manipulate transactions without raising any suspicion.

5. Online Scams

Online scams are the most common forms of Cyber fraud in Africa, with most victims being targeted individually given the vulnerability of many Africans due to limited public awareness.

Paradoxically, individuals who are experiencing financial hardships tend to be more susceptible to falling for scams, thinking that they are the long-awaited solution to their financial struggles. Some of the online scams include;

i) Fake online shops

Shopping scams are where scammers create fake online shops on social media platforms or website stores that present products at highly discounted prices, enticing buyers who are convinced to pay in full or in part only to receive counterfeits or no product at all.

ii) Romance scams

Scammers create fake social media accounts or profiles on dating sites and build trust and emotional connections with victims. In certain cases, the victims are directly targeted through phone SMSs or WhatsApp messages. In many instances, it is an American or European ‘lady’, working as an expatriate in an African country and looking to fall in love with a genuine African man.

Once emotional connections are made, the fraudsters ask for financial favors which start off small and grow bigger. As relations wither, the scammers turn to sextortion by demanding money with threats to share intimate pictures or videos that the victim may have shared during the good times.

iii) Customer support and Tech support scams

Fraudsters present themselves as legitimate representatives of technology or financial companies offering technical assistance to potential victims.

In the process, the fraudsters may gain access to personal information, e-wallet PINS, usernames, and passwords.

iv) Cryptocurrency scams

Given the growing popularity of cryptocurrencies such as Bitcoin and Ethereum in Africa, scammers are enticing investors into buying fake currencies.

v) “Spin and win” schemes

These programs offer rewards such as money, but there’s a catch – you may need to share with friends, install apps, or complete tasks before you can claim your prize. In the end, there’s usually no meaningful payment.

vi) Cash refund schemes

This is where scammers send fake messages to the victims’ phones or emails showing that money has been sent to their mobile money wallets or bank accounts.

The scammers would then contact the victims claiming to have sent the money by mistake and asking for a refund. In certain instances, the victims are even offered a small portion of the money for being good and agreeing to refund the bulk of the money.

Given the sense of urgency often created by the scammers, the victims may end up sending their own money without verifying if they actually received any money to begin with.

vii) Fake jobs/interview scams

These are job opportunities that require you to pay money for interviews or any other part of the application process. Generally, legitimate employers don’t ask candidates to pay for interviews or background checks.

viii) Watching Ads and Videos for Money

While there are platforms through which one can earn some extra cash by watching ads or videos, some of them are middle-level agencies that engage unsuspecting victims who spend their precious time with little to no pay in the end.

It is important to always double-check the legitimacy of such platforms and understand their terms before you dive in.

ix) High-Interest Investment Platforms

These are web-based investment platforms that offer ridiculous returns which when genuine often end up to be some form of pyramid scheme.

x) Fake tenders

This is where scammers target mainly small businesses with fake tenders or orders. They retrieve the victims information online and from listings of pre-qualified suppliers to government parastatals or blue chip companies. Victims may be duped into supplying goods on credit or sending money to facilitate a process or bribe for the award.

What needs to be done

As a continent, Africa needs to create more awareness and develop responsive strategies to the increasing threat posed by cybercrimes and online scams. The African Union and the security agencies of its member states must invest more in training and acquisition of emerging software to curb cybercrime.

Because cyber-criminals enjoy solidarity in the Dark Web where they operate, sell, and share knowledge, Africa’s law enforcement agencies must also seek collaborations on the global stage especially with technologically advanced security agencies to be able to detect and prevent cyber-attacks.

This is especially important given that the growing presence of cybercriminals in Africa is just as much a threat to Africa as it is to other parts of the globe.

“Africa is catching up fast in terms of connectivity; a double-edged sword that creates both development opportunities and threats to people’s security and that of their property. It is also clear that the power of the Internet has erased borders across the world. A cyber-attack launched from Africa can reach a target anywhere in the world, which is why we must mount a joint response to the global scourge of cybercrime,”

Ambassador Jalel CHELBA Ag. Executive Director of AFRIPOL