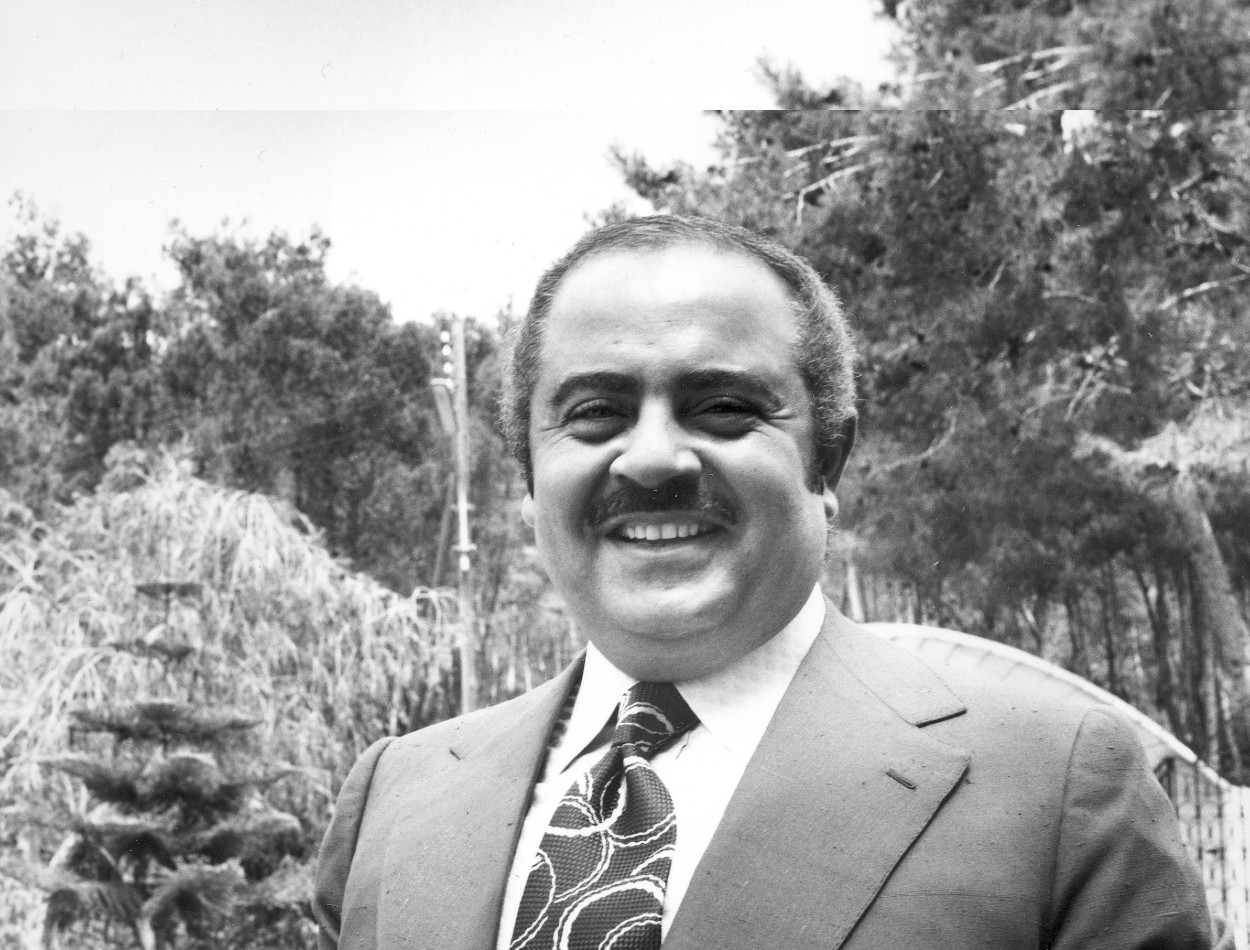

The battle between the South African Revenue Service (SARS) and billionaire Christo Wiese has intensified following a significant court defeat for the mogul.

Wiese and three other defendants lost a legal battle at the Supreme Court of Appeal (SCA), potentially obligating them to pay SARS R216 million ($11.9 million).

Christo Wiese, one of South Africa’s richest men with a net worth of $1.4 billion, and his associates Isak Visagie, Gert Viljoen, and Frederick Hofmeyr, have been embroiled in a multiyear dispute with SARS. The Revenue Service claims the defendants owe substantial taxes.

SARS previously approached the High Court to declare the four defendants jointly and severally liable to pay R216 million ($11.9 million) under Section 183 of the Tax Administration Act, No. 28 of 2011 (TAA). The TAA stipulates: “If a person knowingly assists in dissipating a taxpayer’s assets in order to obstruct the collection of a tax debt of the taxpayer, the person is jointly and severally liable with the taxpayer for the tax debt to the extent that the person’s assistance reduces the assets available to pay the taxpayer’s tax debt.”

SARS argued that the defendants knowingly assisted Energy Africa (Pty) Ltd, ultimately owned by Titan Premier Investments (Wiese’s investment vehicle), in dissipating its sole asset (a loan claim) on April 19, 2013, to its holding company, Elandspad Investments, to obstruct the collection of a tax debt.

Unpaid tax debt

Tax Consulting SA noted that this dissipation occurred after the taxpayer and its advisors were informed by SARS on November 16, 2012, that assessments for the 2007 tax period would be issued to recover unpaid taxes.

“On August 21, 2013, SARS issued the promised additional assessments to include the tax debt, which consists of capital gains tax totalling R453,126,518 (CGT debt) and secondary tax on companies totalling R487,205,316 (STC), plus interest and penalties,” Tax Consulting SA said.

However, the taxpayer claimed it had no funds to pay the debt. By May 2014, the assessment was accepted as correct. In April 2016, the taxpayer was liquidated.

The High Court ruled that the phrase “tax debt” means the amount of tax due or payable. Although the defendants argued that a “tax debt” is only due when SARS issues an assessment, the court determined that the CGT and STC debts should have been paid during the 2007 tax period, indicating that a tax debt already existed.

Moreover, the SCA emphasized that an assessment does not establish a tax liability as the tax liability exists by operation of law. The purpose of Section 183 is to impose liability on a third party who obstructs SARS from collecting a tax debt.

Another issue the SCA had to determine was whether evidence gathered behind closed doors is admissible in court. The SCA found that SARS was within its rights to use evidence given by Wiese and his associates during a Section 50 inquiry against them. Section 50 inquiries are established by order of a high court judge on application by SARS, which must demonstrate reasonable grounds to believe that relevant material is likely to be revealed during the inquiry.

The judgment affirmed that the transcript of evidence from the Section 50 inquiry is admissible in litigation between the parties, stating that the purpose of an inquiry would be frustrated if SARS were constrained to only use information obtained during the inquiry in subsequent proceedings under the TAA.

Tullow’s capital flight

SARS argues that Wiese and Viljoen, a former executive at law firm ENSafrica, created a tax structure to help Irish oil firm Tullow shift assets valued at billions of rand out of the country, avoiding taxes in the process.

Court documents allege that ENSafrica’s restructuring of Tullow was a “sham” and an “elaborate scheme intentionally designed to facilitate the evasion of tax.”

The SCA judgment read: “In this instance, reading in of the words ‘tax proceedings’ is not necessary to realize the legislative intention, nor to make the Tax Administration Act workable.

On the contrary, if SARS is constrained to only use information obtained during an inquiry in subsequent proceedings under the Tax Administration Act, the purpose of an inquiry would be frustrated. Such an interpretation would render these sections nugatory.”

“In light of the text of the relevant sections of the Tax Administration Act and the approach to comparable provisions in the Companies Act and the Insolvency Act, the transcript of the evidence given at the Section 50 inquiry is admissible in the litigation between the parties.”

The move by SARS is part of a broader crackdown against high-net-worth individuals, with the revenue service looking to ensure tax compliance among the super-rich whose tax affairs are usually quite complex due to their extensive assets locally and internationally. To this effect, SARS has established a special High-Wealth Individual (HWI) unit to manage the tax affairs of rich South Africans.

As a matter of fact, in the 2023/24 fiscal year, SARS successfully collected an additional R12.5 billion in taxes from the HWI group.