In weaving African success stories, some names go unnoticed. For Westerners who confuse Africa as a single country, a narrow list of billionaires makes up their list of successful individuals from this vast continent.

Outside South Africa, very few celebrate Michiel Le Roux, the Capitec Bank founder and one of the brains behind its rise and popularity among the biggest African economy’s middle class.

According to Forbes billionaires’ list, he is ranked 17 in Africa, with an estimated $1.3 billion net worth. His wealth was made from banking as he holds interest in different banks and wealth funds.

While in the past decade, he has reduced his holding in Capitec Bank, he is still among the top individual investors with a huge stake in the lender. He co-founded the bank in 2001 alongside Jannie Mouton and Riaan Stassen.

Le Roux holds an 11% stake in the lender. His in-banking traces back to his time as an employee for small regional banks including Boland Bank in the Cape Town region. It is this experience that helped him build a leading bank in South Africa.

Observers have argued that Capitec managed to penetrate the South African market because of its founder’s better understanding of the underserved markets in the economy.

While some lenders have slowed over the past decade due to an economic slowdown in the country, the bank has been able to record steady growth, in turn making Le Roux one of the wealthiest on the continent.

The bank’s innovative approach to service delivery has also helped it stay ahead of the curve in a highly competitive market. As the most industrialized African nation, South Africa is a very sophisticated market in that not so many businesses succeed.

Where did it all start? Who is Michiel Le Roux?

Where it all started

It’s hard to say whether Le Roux is a recluse, he has featured prominently in media reports and has been involved actively in public life including funding opposition political parties in South Africa.

But little is known about his family and personal life. He has managed over the years to hide this from public scrutiny and the glare of media cameras.

He has fondly mentioned his family and wife in past media interviews, explaining that his family has shaped most of his values.

Le Roux, 73, was born in Stellenbosch, South Africa. He holds a degree and a master’s in law from the University of Stellenbosch. He never studied law even though his dream was studying law.

Le Roux’s early career is not clear, but media reports have widely claimed that he headed Boland Bank before founding Capitec.

He has said in past media interviews and investor briefings that the model he adopted at Capitec was an improvement to some of the things that he thought were wrong with banking in South Africa.

“I discovered at Boland Bank that banking was very archaic.”

he said in a past interview

He particularly had an issue with why banks were closing at 3.30 pm, which was a tradition at his former employer Boland Bank. He mapped out a strategy to build a successful bank using the lessons he had picked over the years.

“I thought banks closed at that time because of some kind of law, but it turned out that there was no law that stated that. That was one of the things that I wanted to change, a lot of the staff was not happy about this. When we started at Capitec, there were no hours, we don’t close at 15:30,” he said.

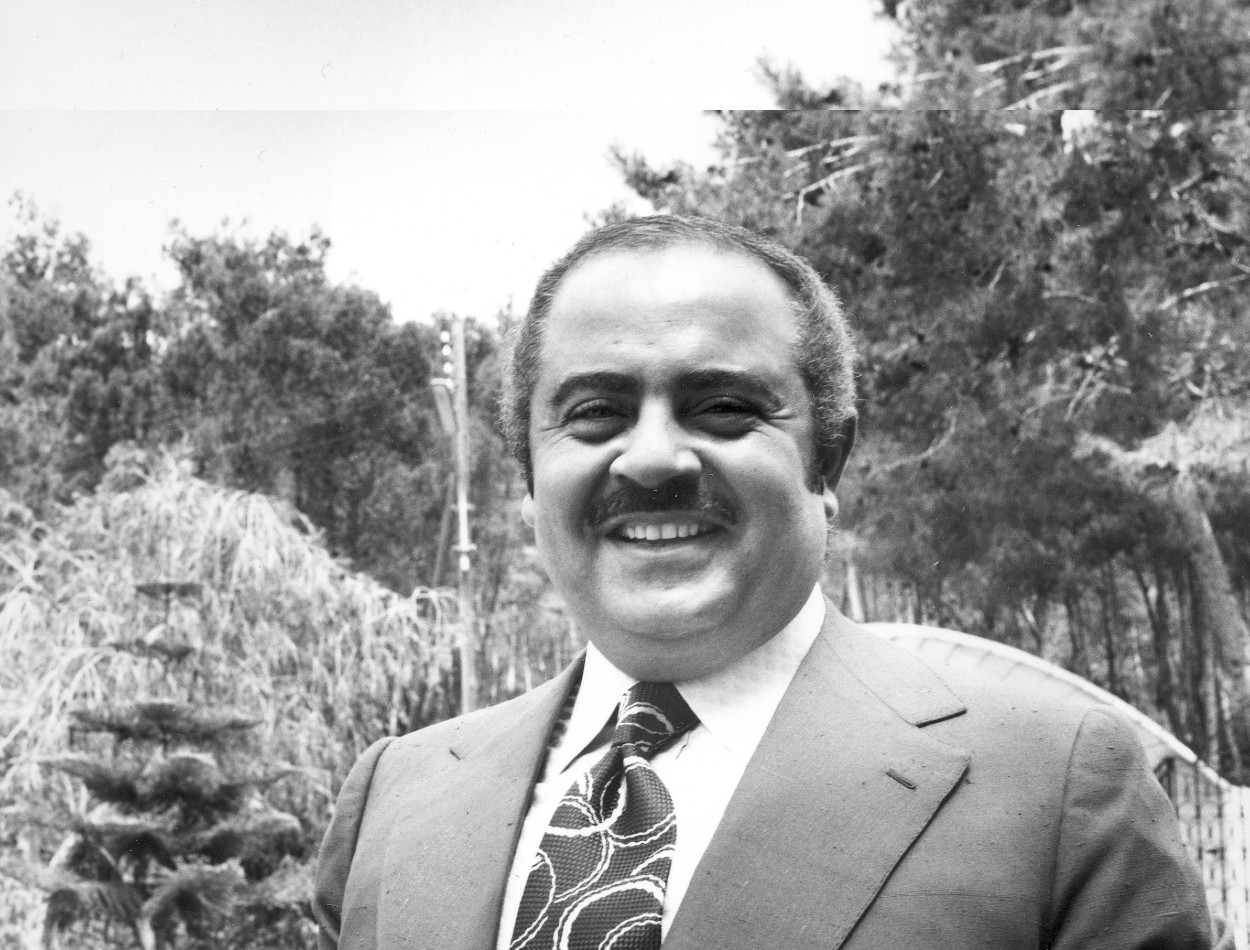

Michiel Le Roux

Capitec

Le Roux wanted to disrupt the South African banking sector–by doing things differently. He has said that he did not envisage the kind of success that the bank has recorded. But he knew that their establishment would do things differently.

“I told our shareholders we’ll either be a big success or a small failure. Not in my wildest dreams could I foresee the success we’ve had.”

he said

Today, the bank is the second strongest brand in South Africa with a score of 93 out of 100 and a rating of AAA+. Attaining this level of success according to Le Roux involved hard work and several strategic decisions.

Capitec Bank was founded in 2001 and listed on the Johannesburg Stock Exchange (JSE) in February of the following year. Le Roux teamed up with banker Riann Stassen and the backing of Jannie Mouton to launch the bank.

At the centre of the bank’s success is 4 simple guiding principles: accessibility, affordability, convenience, and simplicity.

Other business interests

Le Roux has other business interests apart from his 11% stake in Capitec Bank. His interests are mainly in the financial services sector. The following are some of his other known investments:

- Zeder Investments: Zeder Investments Limited was founded in 2006 and has interests in agricultural and food processing companies. Le Roux took a step back from the company in 2014 after resigning as a director.

- South African Trust Fund: The fund gives grants to non-profit organisations that run programmes that target the poor through policy development.

- Capital Alliance Holding: This is a subsidiary of Capitec Bank and provides insurance services.

Political life

Le Roux is one of the big-ticket donors to political parties in South Africa. Unlike in the West where a lot of billionaires contribute billions of funds to political parties, in the rainbow nation, there is a small group of wealthy individuals who do that. Le Roux is among the few billionaires who give money to political parties.

Others are online gambling tycoon Martin Moshal, mining magnate Patrice Motsepe, Victoria Freudenheim, Mary Slack, Jessica Slack-Jell, Rebecca Oppenheimer, and hair products tycoon Herman Mashaba.

Motsepe’s contributions are spread across different political parties while the others give to single or two political outfits. For Le Roux, the single largest political donor in South Africa, millions go to the South African opposition party DA.

According to party filings, the tycoon has donated $2.7 million to the party. He is reportedly close to party echelons. In 2019, he was appointed to a panel investigating the decline of the party’s performance in elections. This means that besides his generous contributions, he is keen on the direction that the party is taking in South African politics.