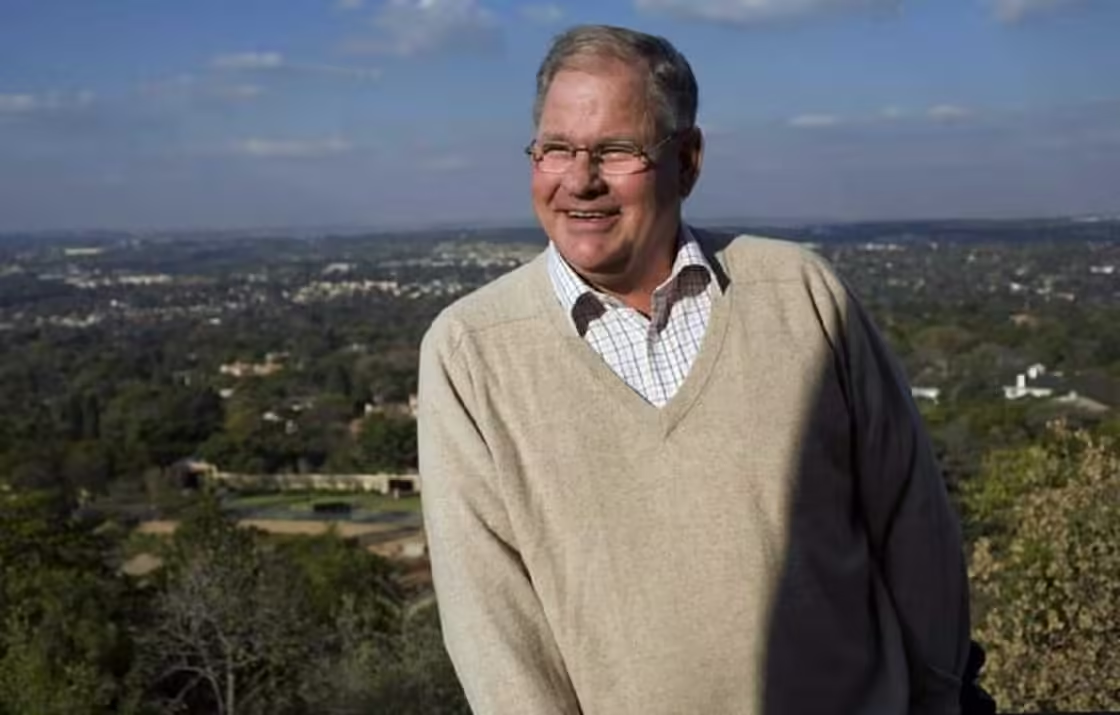

Lauritz Dippenaar is not your typical entrepreneur. In the world of African fintech, where innovation often collides with regulation, he has carved out a reputation as both a visionary and a provocateur. With an estimated net worth of over $50 million, Dippenaar faces a new generation of South African business leaders unafraid to challenge the status quo. But his story is far from a straightforward tale of success. It’s a narrative punctuated by audacious risks, regulatory battles, and a relentless drive to reshape Africa’s financial landscape.

Dippenaar’s journey is one of contrasts. To his supporters, he’s a disruptor who has democratized access to financial services for millions of unbanked Africans. To his critics, he’s a shrewd operator who has occasionally danced on the edge of ethical and legal boundaries. His rise from a middle-class upbringing in Pretoria to the helm of a fintech empire is a testament to his ambition and ingenuity. Yet, it’s also a story that raises questions about the cost of innovation in a region where the game’s rules are still being written.

What sets Dippenaar apart is his ability to thrive in the gray business areas—those spaces where ambition meets scrutiny and the line between opportunity and exploitation can blur. Whether launching a groundbreaking fintech startup, sparring with regulators, or investing in the next wave of African tech talent, Dippenaar has consistently defied convention. Love or loathe him, there’s no denying that he has left an indelible mark on Africa’s financial technology sector.

This is the story of a man who saw potential where others saw only obstacles, turned Africa’s challenges into opportunities, and continues pushing the boundaries of what’s possible—even as the controversies swirl around him.

Contents

Building blocks of a vision

Born 1985 in Pretoria, South Africa, Lauritz Dippenaar grew up in a modest household where resourcefulness was a way of life. His father, a civil engineer, and his mother, a schoolteacher, instilled in him the values of hard work and education. Dippenaar’s entrepreneurial instincts surfaced early. As a teenager, he sold refurbished electronics and organized local events, earning enough to fund his first laptop—a tool that would later become instrumental in his career.

Dippenaar attended the University of Pretoria, where he studied finance and economics. During this time, he became captivated by the potential of technology to transform traditional industries. He spent hours poring over case studies of Silicon Valley startups and analyzing Africa’s untapped markets. “I realized early on that Africa’s challenges were also its greatest opportunities,” Dippenaar said in a 2021 interview. “The lack of infrastructure meant there was room to build something groundbreaking.”

The rise

Fresh out of the University of Pretoria with a degree in finance and economics, Lauritz Dippenaar didn’t waste any time diving into the entrepreneurial deep end. In 2010, at just 25 years old, he co-founded his first company—a fintech startup to tackle one of South Africa’s most pressing challenges: financial exclusion. Millions of South Africans were cut off from traditional banking services, particularly in rural and low-income communities. Dippenaar saw this not as a problem but as an opportunity.

His startup, which began as a modest operation with a handful of employees, focused on providing affordable digital financial services. The cornerstone of its offering was microloans—small, short-term loans designed to help individuals and small businesses bridge cash flow gaps. But what truly set the company apart was its embrace of mobile technology. At a time when smartphones were becoming increasingly accessible, Dippenaar’s team developed a mobile payment platform that allowed users to send, receive, and manage money with just a few taps on their phones.

The timing was perfect. South Africa’s fintech sector was still in its infancy, and Dippenaar’s company quickly gained traction. By 2015, it had become a standout player in the industry, attracting $10 million in venture capital funding from a mix of local and international investors. Among them was a prominent European fintech fund, which saw the startup as a gateway into Africa’s burgeoning digital economy.

Dippenaar’s ability to identify market gaps and execute scalable solutions set him apart from his peers. He wasn’t just building a business but addressing a systemic issue. His company became a case study in how fintech could drive financial inclusion in emerging markets. By 2018, it boasted over 2 million users and processed transactions worth billions of rand annually. For many of its customers, it was their first experience with formal financial services—a testament to Dippenaar’s vision of using technology to empower the underserved.

From fintech to venture capital

With his fintech startup firmly established, Dippenaar turned his attention to the broader African tech ecosystem. In 2017, he launched a venture capital firm focused on early-stage startups, emphasizing sectors like e-commerce, renewable energy, and artificial intelligence. His approach was hands-on: he didn’t just write checks; he actively mentored founders, helped them refine their business models, and connected them with his extensive network of investors and industry leaders.

Dippenaar’s knack for spotting talent and trends quickly earned him a reputation as one of Africa’s most astute venture capitalists. He was often compared to global figures like Marc Andreessen and Peter Thiel for his investment acumen and willingness to back bold, unconventional ideas. One of his early bets was on a Nigerian e-commerce platform that became one of the continent’s fastest-growing startups. Another was a Kenyan renewable energy company that developed innovative solar solutions for off-grid communities.

But Dippenaar’s venture capital journey wasn’t just about financial returns. It was also about fostering innovation in a region long overlooked by global investors. “Africa is the next frontier for tech,” he said in a 2019 interview. “The challenges here are immense, but so are the opportunities. The impact will be transformative if we can solve even a fraction of these problems.”

This phase of Dippenaar’s career solidified his status as a key player in Africa’s tech ecosystem. It also marked the beginning of his evolution from a fintech entrepreneur to a multifaceted business leader with a finger on the pulse of the continent’s most promising industries.

Regulatory battles and ethical questions

Lauritz Dippenaar’s ascent to the top of Africa’s fintech sector has been anything but smooth. While his innovative approach to financial inclusion has earned him accolades, it has also drawn scrutiny—and no small amount of controversy. In 2020, Dippenaar found himself at the center of a storm when allegations surfaced that his fintech company was exploiting regulatory loopholes to gain a competitive edge. Critics accused the company of operating in a legal gray area, mainly regarding its lending practices and data privacy policies.

At the heart of the controversy was the company’s microloan product, which some argued targeted vulnerable populations with high interest rates and opaque terms. Critics also raised concerns about collecting and sharing user data, suggesting that the company’s practices might violate South Africa’s data protection laws. The backlash was swift and fierce, with media outlets and industry watchdogs calling for greater oversight of the fintech sector.

The South African financial regulator took notice and investigated the company’s operations. While no formal charges were brought, the probe cast a shadow over Dippenaar’s reputation and sparked a heated debate about the ethics of fintech in Africa.

Dippenaar, for his part, was quick to defend himself and his company. In a strongly worded press release, he dismissed the allegations as “baseless and politically motivated,” attributing them to rivals who felt threatened by his success. “We’ve always operated within the bounds of the law,” he stated. “Innovation often disrupts the status quo, and that makes people uncomfortable. But that doesn’t mean we’re doing anything wrong.”

The controversy surrounding Dippenaar’s company highlighted a broader tension within the fintech industry. On one hand, fintech has been hailed as a powerful tool for financial inclusion, providing millions of people with access to services they had long been denied. On the other hand, critics argue that the rapid pace of innovation often outstrips the ability of regulators to keep up, creating opportunities for exploitation.

Some industry insiders have accused Dippenaar of embodying this tension. They argue that his aggressive approach to growth—while undeniably effective—sometimes blurs the line between innovation and exploitation. “There’s a fine line between disrupting an industry and taking advantage of regulatory gaps,” said one fintech analyst, who spoke anonymously. “Dippenaar’s company has walked that line more than once.”

However, others have come to his defense, pointing to the tangible benefits his services have brought millions of people. “Yes, there are risks involved in any new technology,” said a former company employee. “But the alternative is leaving people completely excluded from the financial system. Lauritz has done more to empower underserved communities than most traditional banks ever have.”

The 2020 controversy was a turning point for Dippenaar. While he emerged from the investigation unscathed, the experience forced him to reevaluate his approach to business, in the years since he has taken steps to strengthen his company’s compliance framework and improve transparency around its lending practices. He has also become a vocal advocate for more transparent regulations in the fintech sector, calling for a balance between innovation and consumer protection.

“The fintech industry is still evolving, and we all have a role to play in shaping its future,” Lauritz Dippenaar said in a 2022 interview. “We need to innovate responsibly, with a focus on creating value for our customers and society as a whole.”

The controversy, while challenging, has not derailed Dippenaar’s ambitions. If anything, it has added a layer of complexity to his story, underscoring the challenges of building a business in a rapidly changing and often unpredictable industry. For Dippenaar, the lesson has been clear: in the world of fintech, success isn’t just about breaking barriers—it’s about navigating the gray areas with integrity and purpose.

A diverse portfolio

As of 2023, Lauritz Dippenaar’s net worth is estimated to be over $50 million. But reducing his story to a number would mean missing the bigger picture. Dippenaar’s wealth isn’t just about money—it’s about the businesses he’s built, the industries he’s transformed, and the lives he’s touched along the way. His portfolio is as diverse as it is impressive, spanning fintech, venture capital, renewable energy, and even real estate. Each puzzle tells a story of ambition, risk, and a relentless drive to make an impact.

It all started with fintech. In 2010, fresh out of university, Dippenaar co-founded his first company—a digital financial services startup aimed at South Africa’s unbanked population. The idea was simple but revolutionary: use mobile technology to provide micro-loans and payment solutions to people ignored by traditional banks. The company took off faster than anyone expected. By 2015, it had attracted $10 million in funding from investors who saw its potential to disrupt the financial sector. Today, it serves over 3 million users and processes billions of rand in transactions every year.

But Dippenaar didn’t stop there. Over the years, he’s taken stakes in several other African fintech ventures. A Nigerian digital banking platform has become a lifeline for small businesses, and a Kenyan mobile wallet company is reshaping how people in East Africa handle money. These investments aren’t just about returns—they’re about creating systems that empower people who’ve been left behind.

In 2017, Dippenaar launched his venture capital firm, turning his attention to the next generation of African entrepreneurs. His approach is hands-on. He doesn’t just write checks; he rolls up his sleeves and gets involved. His firm has backed over 20 startups, from e-commerce platforms to AI-driven health tech companies.

One of his standout investments is EcoCart, a South African e-commerce platform that’s become a go-to for online shoppers across the continent. Then there’s Solaris Energy, a renewable energy startup bringing solar power to off-grid communities, and MediTech AI, which uses artificial intelligence to improve healthcare diagnostics in under-resourced hospitals. Dippenaar has a knack for spotting talent and trends, and his portfolio reads like a roadmap of Africa’s most promising industries.

Dippenaar’s interests extend beyond tech. He’s a significant shareholder in GreenPath Energy, a Johannesburg-based renewable energy company making waves in South Africa’s solar sector. GreenPath has landed several government contracts to build solar farms, helping to address the country’s energy crisis while creating jobs and driving economic growth.

For Dippenaar, renewable energy isn’t just a business opportunity—it’s a chance to make a lasting impact. “Africa has the potential to lead the global energy transition,” he said in a recent interview. “But it’s not just about clean energy. It’s about building a sustainable future for the next generation.”

Dippenaar’s portfolio also includes a growing list of real estate investments. From commercial properties in Johannesburg and Cape Town to residential developments to address South Africa’s housing shortage, his real estate holdings are as strategic as they are diverse. These investments provide a steady income stream while contributing to developing communities nationwide.

Dippenaar’s success has made him a sought-after voice in Africa’s business community. He’s a regular on the conference circuit, speaking at events like the Africa Tech Summit and the World Economic Forum on Africa. His message is always the same: Africa is a continent of untapped potential, and the key to unlocking it lies in collaboration between governments, investors, and entrepreneurs.

“Africa isn’t just a place to do business—it’s a place to build the future,” he said during a keynote address in 2023. “We have the talent, the resources, and the drive to create something extraordinary. But we need to work together to make it happen.”

Lauritz Dippenaar’s $50 million net worth is impressive, but it’s only part of the story. What sets him apart is his ability to see opportunities where others see obstacles—and his willingness to take risks to turn those opportunities into reality. Whether through fintech, venture capital, renewable energy, or real estate, Dippenaar is building a legacy beyond wealth.

He’s a man who thrives on challenges, isn’t afraid to push boundaries, and believes in innovation’s power to change lives. And as he continues to explore new frontiers—from blockchain to artificial intelligence—one thing is clear: Lauritz Dippenaar isn’t just building a fortune. He’s building a future.

The personal side

Despite his public profile, Lauritz Dippenaar is fiercely private about his personal life. He is married to Anika van der Merwe, a former marketing executive, and the couple has two children. Friends describe him as a devoted family man who values his time at home, away from the spotlight’s glare.

Lauritz Dippenaar is also a committed philanthropist. He has donated millions to educational initiatives, including scholarships for underprivileged students and funding for STEM programs in rural schools. In 2022, he launched the Dippenaar Foundation, which focuses on youth empowerment and environmental sustainability.

Blockchain, AI, and beyond

Lauritz Dippenaar shows no signs of slowing down. He is currently exploring opportunities in blockchain technology and artificial intelligence, areas he believes will define the next wave of innovation in Africa. “Blockchain has the potential to revolutionize everything from supply chains to voting systems,” he said in a recent interview. “And AI? It’s going to be a game-changer for healthcare and education.”

Lauritz Dippenaar is also eyeing expansion into other African markets, including Nigeria and Kenya, where fintech adoption is rapidly growing. His venture capital firm is actively scouting for startups in these regions, focusing on sectors like agritech and healthtech.

The legacy

Lauritz Dippenaar’s story is one of ambition, innovation, and resilience. He has proven that building a business empire in one of the world’s most challenging environments with vision and determination is possible. Yet, his journey also underscores the complexities of entrepreneurship in emerging markets, where the lines between disruption and regulation are often blurred.

Whether viewed as a trailblazer or a provocateur, Dippenaar’s impact on Africa’s tech and financial sectors is undeniable. As he continues to push boundaries and explore new frontiers, one thing is clear: Lauritz Dippenaar is a name that will remain at the forefront of Africa’s business landscape for years.