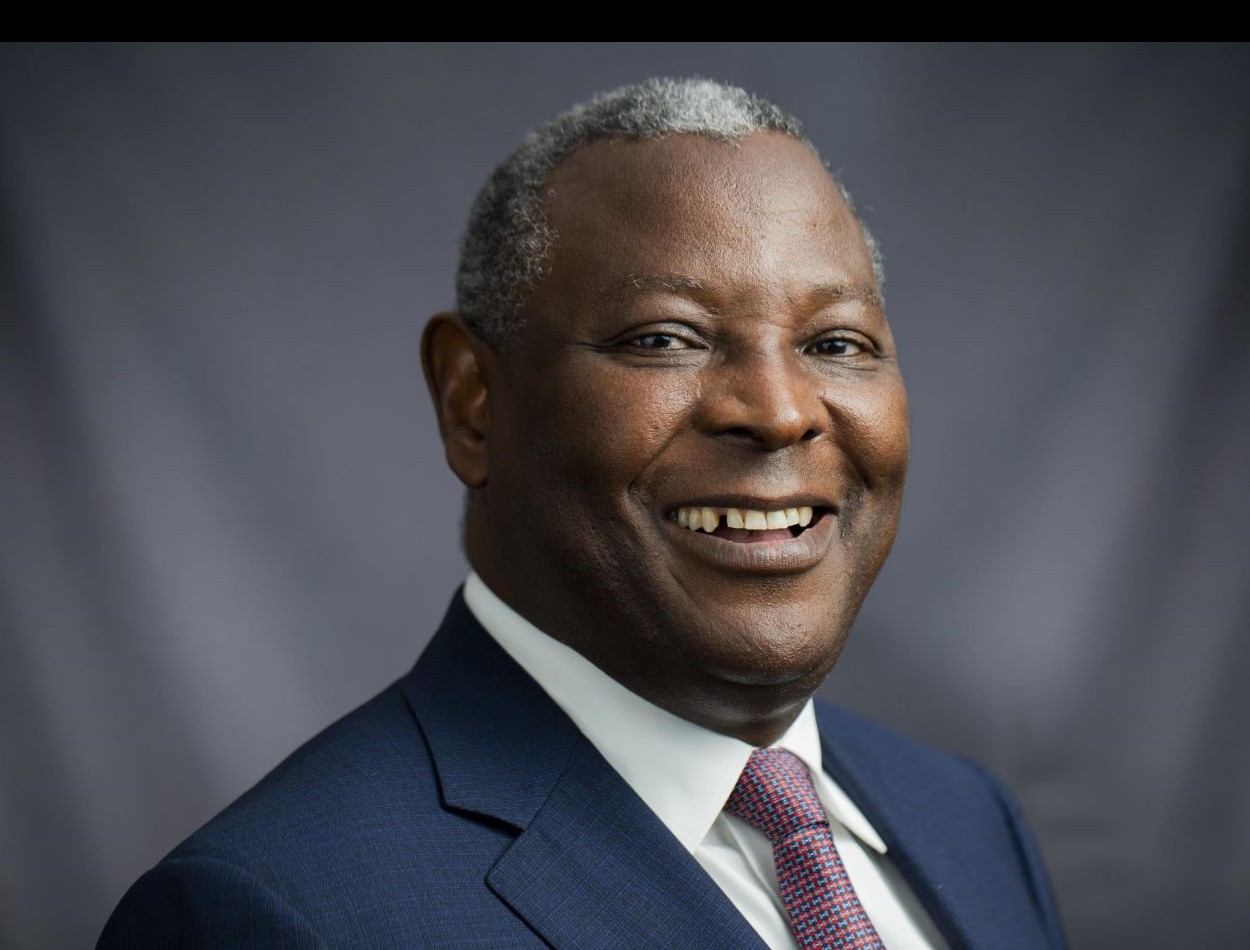

Femi Otedola’s name proudly occupies the 20th spot on Forbes’ live updates of Africa’s billionaires as of February 2024, a testament to his remarkable journey to becoming one of Nigeria’s wealthiest individuals.

Known affectionately as “Ote$,” Otedola’s entrepreneurial prowess and resilience have earned him widespread recognition and admiration in both business and social circles across Africa.

It has not always been rosy for the 61-year-old tycoon. He rose and fell hard before picking the pieces and building $1.2 billion in investments, according to Forbes.

Contents

Where it all started

Born in Ibadan, Nigeria, Femi Otedola was the son of Michael Otedola, a respected businessman who served as the Governor of Lagos State.

Despite being born into a privileged background, Otedola demonstrated an early entrepreneurial spirit, establishing his first business venture, FEMCO, at the tender age of six, offering manicure and pedicure services to relatives and family friends.

Educated at the University of Lagos Staff School and later at Olivet Baptist High School, Otedola honed his entrepreneurial skills while working at his father’s printing company during school holidays.

He went on to earn his undergraduate degree from Obafemi Awolowo University in 1985, immersing himself in the intricacies of business management and finance.

Building a business empire

In 1994, Otedola founded Center Force Limited Company, focusing on finance, investments, and trading, marking the beginning of his journey into entrepreneurship.

However, it was his foray into the oil industry that would propel him to greater heights of success.

Recognizing the lucrative potential of Nigeria’s oil sector, Otedola founded Zenon Gas & Petroleum Limited in 2003, rapidly transforming it into a multi-million-dollar enterprise.

Zenon specialized in importing and distributing diesel across Nigeria, boasting an impressive client roster that included industry giants such as Dangote Group, Cadbury, Coca-Cola, MTN, and Nigerian Breweries.

Under Otedola’s leadership, Zenon expanded its operations, investing in large cargo vessels and storage depots to meet the growing demand for diesel in Nigeria.

Notably, Zenon’s acquisition of a flat-bottomed bunker vessel with a storage capacity of 16,000 metric tons marked a significant milestone in the company’s growth trajectory, solidifying its position as a major player in the oil and gas industry.

In 2007, Otedola orchestrated Zenon’s acquisition of a 28.7% stake in African Petroleum Plc, subsequently rebranding the company as Forte Oil Plc (FO Plc) and assuming the roles of board chairman and CEO.

The same year, he secured a syndicated loan of $1.5 billion backed by 10 Nigerian banks for Zenon to build the largest premium motor spirit storage facility in Africa. Like they say, these are the good loans; the ones taken to invest.

This strategic move further bolstered Otedola’s influence in the energy sector, cementing his reputation as a visionary business leader.

On the verge of bankruptcy

Despite his meteoric rise to success, Otedola faced a formidable challenge in 2008 when a series of unfortunate events threatened to derail his entrepreneurial endeavors.

The collapse of global oil prices, at a time when he had over 1 million barrels of oil in the high seas, headed for Nigeria, coupled with the devaluation of the Nigerian currency, inflicted significant financial losses on Forte Oil, plunging Otedola into a staggering $1.2 billion debt.

Within months, Otedola lost over $480 million due to the crash of global oil prices, $258 million through the devaluation of the naira, a further $320 million due to accruing interest, and $160 million from the dip in stock prices, leaving Otedola in $1.2 billion debt.

This led to him missing on the Forbes list of Africa’s top billionaires that year.

However, Otedola chose to confront adversity head-on, embarking on a journey of recovery marked by resilience and determination.

Through strategic decision-making and prudent financial management, he successfully navigated Forte Oil through turbulent waters, relinquishing assets and restructuring his business to mitigate the impact of the crisis.

Bouncing back and diversifying investments

In a remarkable display of resilience, Otedola emerged from the brink of bankruptcy stronger and more determined than ever.

He diversified his investment portfolio, divesting his shares in Forte Oil and redirecting his focus towards Geregu Power Plc, one of Nigeria’s largest power stations, and extensive real estate ventures in Lagos, Dubai, London, and Monaco.

Moreover, Otedola expanded his influence in the financial sector, acquiring stakes in leading firms such as Zenith Bank and FBN Holdings Plc, where he assumed prominent roles on the board of directors.

His strategic investments and prudent financial management have positioned him as a key player in Nigeria’s banking and finance industry.

Furthermore, Otedola’s philanthropic endeavors underscore his commitment to social responsibility and community development.

Blessed with four children, he has dedicated himself to supporting various charitable causes, leveraging his resources and influence to make a positive impact on society.

In 2023, Femi Otedola, increased his stake in Transcorp to 6.3 percent making him the largest single individual shareholder.

Transnational Corporation Plc (Transcorp), is a publicly traded diversified conglomerate linked to billionaire banker Tony Elumelu.

Femi also bought a stake in the Dangote Cement Company owned by Africa’s richest man, Aliko Dangote.

He has also been a board member of the Nigerian Chamber of Shipping and Transcorp Hilton Hotel, Abuja.

Further, he was part of the National Economic Management Team, chaired by former President Goodluck Jonathan from 2011 to 2015.

Controversies and legacy

Despite his immense success, Otedola has not been immune to controversy. In 2012, he was embroiled in a fuel subsidy scandal, facing allegations of bribery in connection with his company’s involvement in the subsidy scheme.

While the allegations were eventually settled, the incident served as a stark reminder of the complexities and challenges inherent in Nigeria’s business landscape.

Nevertheless, Otedola’s legacy as a pioneering entrepreneur and visionary leader remains intact, serving as an inspiration to aspiring business leaders across Africa.

His resilience in the face of adversity, and commitment to excellence epitomize the qualities of a true business titan.

As Otedola continues to make strides in his entrepreneurial journey, his story serves as a powerful reminder that success is not defined by one’s circumstances but by one’s resilience, determination, and unwavering belief in the power of possibility.

In the words of Otedola himself, “An entrepreneur knows what he knows.” Indeed, Femi Otedola’s journey from adversity to triumph is a testament to the indomitable spirit of entrepreneurship.