Technology multinationals from Meta to Google are scrambling to upgrade Africa’s digital infrastructure at a frenetic pace to lower the cost of access to their services, but one challenge that lingers is the cost. For most Africans, mobile internet costs outpace incomes, locking out millions from the increased connectivity.

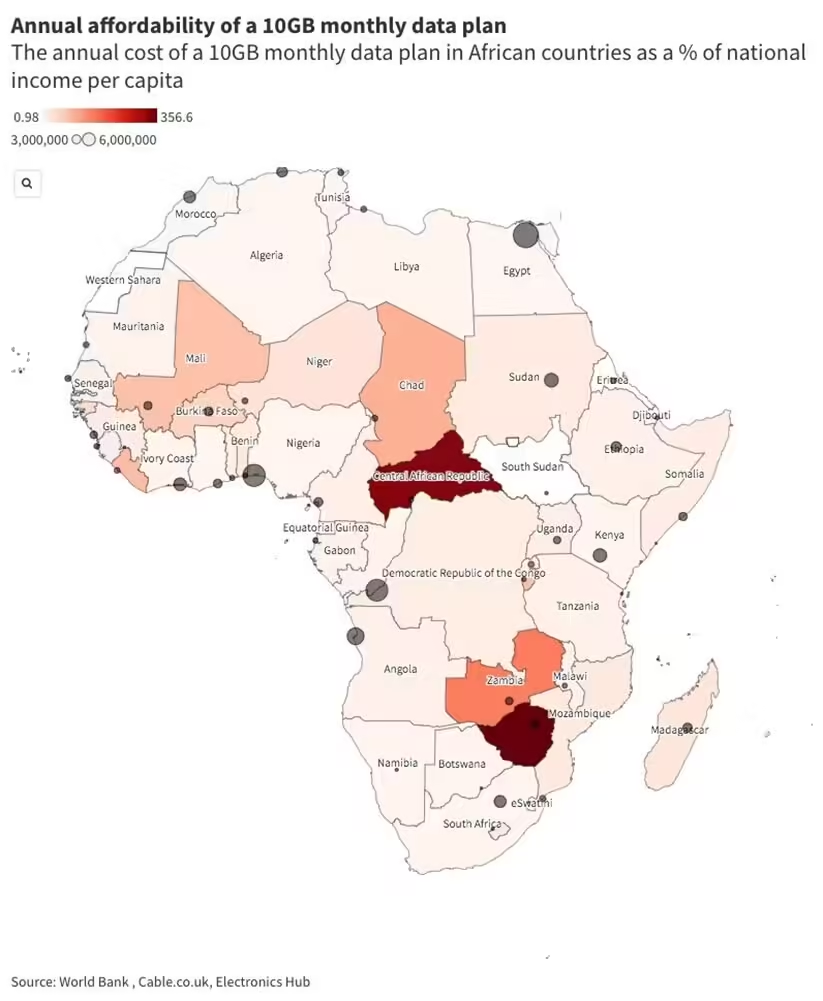

Data from the World Bank and Cable.co.uk, a global internet price comparison site, show that African countries have the worst value internet in the world. Internet users across Africa pay more by up to 356% for less speed and reliability.

African nations top the rankings of the most expensive countries for mobile internet, the worst value broadband internet, and the least affordable places to get a broadband plan. This indicates that the billions global infrastructure investors have put in undersea cables, data centres, and other supporting infrastructure are yet to benefit the over one billion people living on the continent.

War-torn Africa

A major factor why the internet is expensive is the high cost of infrastructure investment that telcos and other ISPs put to expand coverage. A significant part of the continent is still difficult to access, pushing up the cost of moving equipment to build systems like mobile masts. For instance, only 41% of roads in Burundi are motorable–according to the East African Community’s (EAC) Northern Corridor Authority, making a huge chunk of the country inaccessible.

The same is the case with war-torn Chad and the Central African Republic (CAR) where government troops and rebel groups have been wrestling for control, abandoning public services like building roads and laying internet cables.

This increases the initial set-up cost required to expand broadband coverage. Burundi appears in all three most expensive rankings and is the least affordable country for broadband internet while Chad and CAR are among the countries with the most expensive 10GB monthly data plan.

In Burundi, residents pay 2953.85% of the average yearly income for an annual broadband plan. Many countries with the best value internet broadband, such as Sweden, Singapore, and Denmark, benefit from high wages, which help offset their broadband costs.

Low number of ISPs

Another factor is the low number of ISPs in most African markets, with some players enjoying a near monopoly in countries like Ethiopia. Before the entry of Kenya’s Safaricom in 2021, as part of Prime Minister Abiy Ahmed’s economic liberalisation push, state-owned Ethio Telecom was the only operator.

Ethiopia trails neughbouring Kenya, Uganda, and Tanzania on the cost of internet relative to download speeds. Its East African neighbours liberalised their telecom sectors in the late 1990s and early 2000s, permitting private operators.

When examining the annual affordability of a 10 GB monthly data plan–annual cost as a percentage of net national income–nine of the top ten least affordable plans are found in Africa. Zimbabwe stands out with the worst-value mobile plan, where a year’s data costs 356.60% of the average annual income.

The other countries fairing poorly on this metric are the Central African Republic (334.49%), Zambia (156.38%), Chad (100.92%), Liberia (87.36%), Burundi (84.66%), Mali (82.64%), Gambia (70.15%) and Burkina Faso (58.84%). Except for Liberia and Gambia, the other countries are landlocked, highlighting that the cost of access to the internet is lower in countries with coastlines where undersea cables land.

Countries that have seen more investments to improve internet plumbing in the last decade are slightly more affordable. In sub-Sahara Africa, Ghana has the cheapest 10GB monthly data plan at 2.63%. It is followed by its West African neighbour Nigeria (2.75%), Namibia (3.58%), South Africa (3.80%), and Kenya (3.94%)–all coastal countries.

Unsurprisingly, the countries with cheap internet on the continent are well positioned for opportunities in remote and gig work as this requires intensive internet use. South Africa, Nigeria, Kenya, and Ghana have the most active startup ecosystems on the continent.

Looking at the cost of internet broadband relative to download speed, African countries once again top the list, with Eritrea ($338.15 for 10GB) and Burundi ($159.15) being the two most expensive territories. The cheapest markets are a mix of European and Asian territories, with Romania ranking first. Locals pay only $0.01 per Mbps of download speed.

Electronic Hub’s analysis shows that African users have to contend with slow and costly internet, which does not favour enterprises or individuals needing video streaming or cloud computing services. Congo has the cheapest internet relative to download speed at $0.46, followed by Rwanda and Togo at $0.51. The top destinations for internet investments including South Africa and Nigeria cost $0.60 and $1.72 respectively while Kenya is $1.76.

Partly because of the high costs, half of the population in Africa has access to mobile internet coverage but does not log in, according to GSMA, a telecom sector body.

A long way to go

Many projections show that the number will grow by the end of the decade to nearly 700 million people–however, users will demand faster internet at lower costs.

But there are some countries that still have low coverage rates because of years of instability. Statistics show that Burundi, Central African Republic and Chad are among the countries with high broadband costs.

A dramatic drop in the cost of the internet and an increase in speeds require more than an infrastructure investment boom–it has to be supported by corresponding policies like lower taxes.

For instance, higher taxes on internet and phone services in Kenya has reversed gains made in the last decade to lower costs and grow the penetration. A 15% excise duty that the country’s treasury ministry introduced in 2022 saw an increase in broadband prices, pushing it beyond the reach of many people.