In the bustling world of high-profile investors and business magnates, one figure stands out for his deliberate avoidance of the limelight: Baloobhai Patel.

The enigmatic Kenyan investor, often described as a recluse, has been quietly shaping the economic landscape, leaving an indelible mark on various industries while maintaining an aura of mystery.

A recluse in the public eye, Patel’s strategic investments weave an intricate tapestry of economic influence.

For people who do not know him personally, the face they can put to the name is an old grainy picture of him available online. That is the only picture of him available on the internet.

Contents

The Man behind the mystery

Born and raised in Nairobi, 86-year-old Baloobhai Patel is a name known to very few outside the inner circles of the business world.

Little is known about his personal life, and attempts to unveil the man behind the mystery have been met with guarded silence.

Colleagues and associates describe Patel as an intensely private individual, whose sole focus appears to be on the strategic investments that have earned him a formidable reputation in the financial sector.

The billionaire, whose interests span real estate, technology, and listed equities, has accumulated shares in major companies listed at the Nairobi Securities Exchange (NSE) making him a force to reckon with.

Strategic investments across sectors

Despite his preference for privacy, Patel’s influence is palpable across a spectrum of industries.

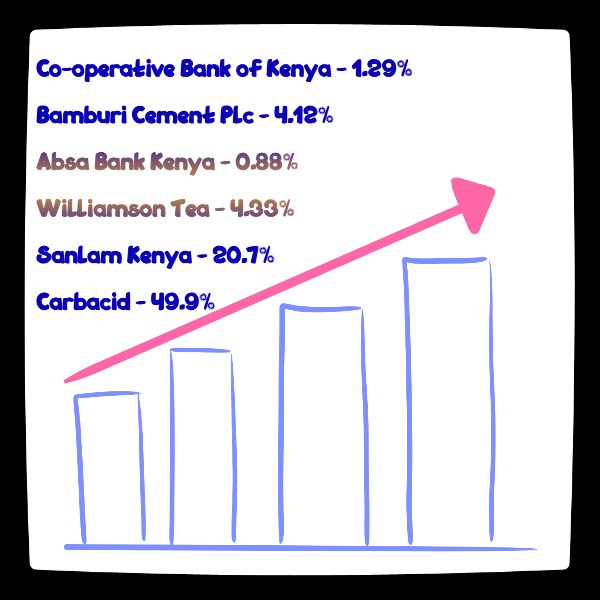

Sources close to the investor revealed that Patel holds substantial stakes in a range of companies including Kenya’s Cooperative Bank, Absa Bank Kenya, Carbacid Investments, Sanlam Kenya, Williamson Tea and Bamburi Cement.

He recently bought an additional 20.5 million shares in Cooperative Bank, pushing his stake in Kenya’s third-largest bank to 1.29 percent.

He has a cumulative 75.6 million shares in the NSE-listed lender, valued at $5.26 million (Ksh855.2 million).

Last year, he bought an additional 2.5 million shares in Absa Bank Kenya, pushing his stake to from 0.88% to 0.92 percent.

He owns stakes in Bamburi (4.12%), Williamson Tea (4.33%), Sanlam Kenya (20.7%), and Carbacid (49.9%).

The stakes in the firms are held through Aksaya Investment Holdings. The billionaire previously owned the listed equities alone but introduced his wife Amarjeet Baloobhai Patel as a co-director in 2015.

It is reported that their son Rohan Patel, who manages the tycoon’s real estate investments, has taken an active role in managing his portfolio in what could point to a succession plan.

Patel has interests in upmarket property developments, particularly in Nairobi’s commercial districts.

Evidently, his investments are not limited to a single industry, showcasing a diverse portfolio that reflects a keen understanding of market dynamics.

His foresight in recognizing the potential of listed firms has allowed him to capitalize on the bear run at the NSE, positioning him as a key player in Kenya’s stock exchange.

Patel has also made inroads into the renewable energy sector. Sources indicate that he holds considerable shares in a solar energy company at the forefront of green energy initiatives in East Africa.

This strategic move aligns with global trends towards sustainability, showcasing Patel’s forward-thinking approach to investment.

A Legacy of secrecy and success

Baloobhai Patel’s success in the business world is often attributed to his ability to remain elusive and maintain a low profile.

While his investments speak volumes about his financial acumen, the secrecy surrounding his personal life adds an air of mystique to his persona.

Some speculate that Patel’s reclusive nature is a deliberate strategy, allowing him to navigate the complex world of business discreetly and make strategic moves without attracting unnecessary attention.

And as Kenya and the broader East African region continue to experience economic growth, Baloobhai Patel’s influence is expected to play a pivotal role in shaping the trajectory of key industries.

The story of this reclusive investor serves as a testament to the idea that in the world of finance, sometimes the most powerful players are the ones who operate in the shadows, orchestrating economic symphonies that resonate far beyond the public eye.