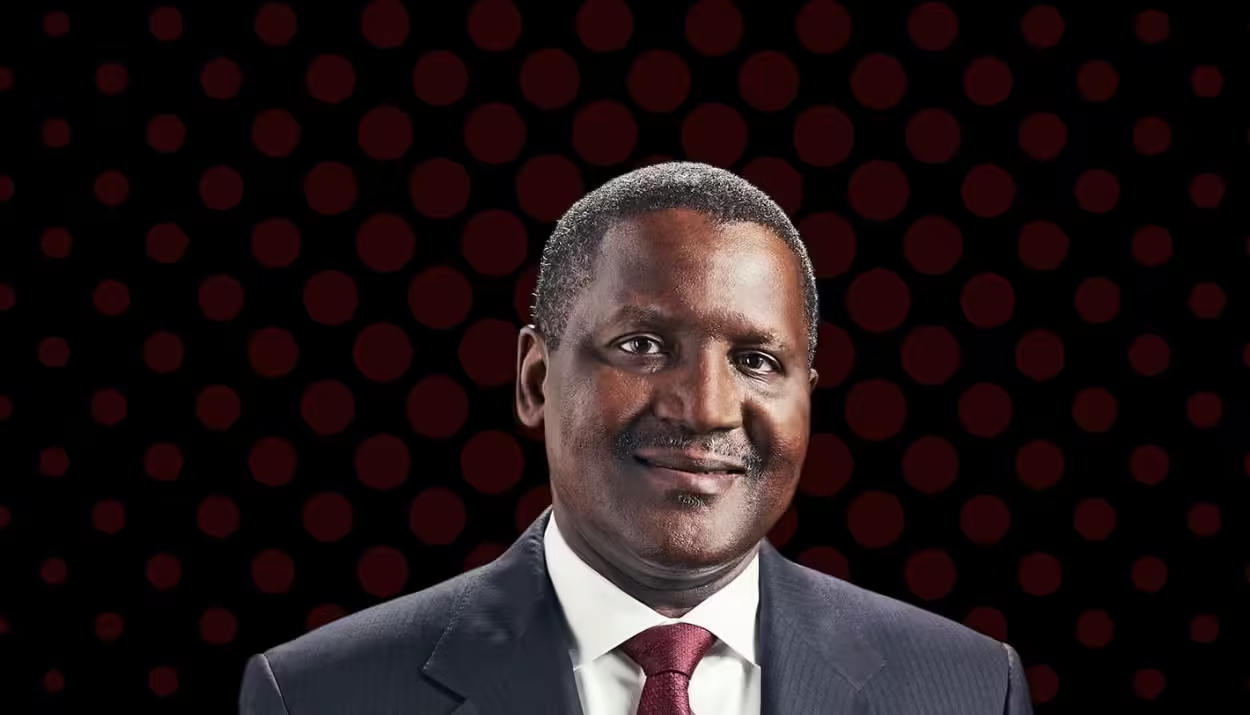

Aliko Dangote, Africa’s richest man and the head of the Dangote Group, is embroiled in a series of conflicts with Nigeria’s regulatory authorities, raising concerns about the country’s investment climate.

Most recently, the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) accused Dangote of monopolizing the oil sector and attempting to extend this dominance to the steel sector.

The regulator also claimed that the tycoon’s $19 billion facility which only recently started production has been producing substandard products compared to imported goods, citing high sulfur levels in locally refined diesel.

Farouk Ahmed, the chief executive of NMDPRA, stated that Dangote’s products contain sulfur levels between 650 to 1,200 parts per million (ppm), far above the 50ppm standard required by West African regulations.

“The AGO quality in terms of sulphur is the lowest as far as West Africa’s requirement of 50 parts per million (ppm). Dangote refinery, as well as some major refineries like Waltersmith refinery, produce between 650 ppm to 1,200 ppm. So, in terms of quality, their quality is much more inferior to the imported quality,” the NMDPRA boss said.

Dangote has denied these allegations, accusing the regulatory body of allowing the importation of “dirty fuel” into the country. During a recent tour of his refinery and fertilizer complex by the Speaker of the House of Representatives, Tajudeen Abbas, and other members, lab tests conducted at the site showed that Dangote’s diesel had a sulfur content of 87.6 ppm, significantly lower than the imported samples which exceeded 1,800 ppm.

“We produce the best diesel in Nigeria. It’s disheartening that instead of safeguarding the market, the regulator is undermining it. Our doors are open for the regulator to conduct tests on our products anytime; transparency is paramount to us,” Dangote stated.

“You’ve witnessed the results of the credibility test. I appreciate your wise counsel in procuring samples from the filling stations alongside our refinery’s product. Ours shows a sulphur content of 87.6 ppm, approximately 88, whereas the others exceeded 1,800 ppm. Although the NMDPRA permits local refiners to produce diesel with sulphur content up to 650 ppm until January 2025, as approved by ECOWAS, ours is significantly lower. Next week, we aim to achieve 10 ppm, aligning with the Euro V standard. Imported diesel is capped at 50 ppm, but as you’ve seen, those from the stations, imported by major marketers, fall well outside this standard,” he added.

Contents

Monopoly allegations

Besides quality issues, Dangote is also accused of attempting to monopolize the oil sector by pushing for a ban on the importation of diesel and aviation fuels. Ahmed argued that such a move would harm the market by creating a monopoly especially with Dangote heading one of the world’s largest refineries.

“Dangote is requesting that we should suspend or stop the importation of all petroleum products … and that is not good for the market because of monopoly,” Ahmed said.

Dangote countered this by expressing his willingness to sell his refinery to the Nigerian National Petroleum Corporation Limited (NNPCL) if accusations of monopolization persist.

“Let them (NNPCL) buy me out and run the refinery the best way they can. They have labelled me a monopolist. That’s an incorrect and unfair allegation, but it’s OK. If they buy me out, at least, their so-called monopolist would be out of the way,” Dangote told PREMIUM TIMES.

Dangote’s conflicts with oil majors

Dangote has been vocal about the obstacles he faced in constructing and commencing production in his $19 billion refinery, claiming that oil majors have been obstructing his access to crude oil.

Since January, the refinery, with a capacity of 650,000 metric tons, has been operating at just above half its capacity due to a lack of crude oil supplies. The refinery has had to source crude from distant markets like Brazil and the United States and is reportedly now negotiating with Angola and Libya

Meanwhile, the NNPCL with whom the refinery has a supply deal had only delivered 6.9 million barrels of oil to the plant as of May of last year, according to to S&P Global Platts, a tracker of supply data.

NNPCL and Dangote refinery had previously agreed to a 20 per cent equity participation. However, the refinery has claimed that only 7.2 per cent has been fully paid for before the deadline issued to the company to acquire the stake.

Impact on Investments

The ongoing regulatory challenges facing Dangote could have broader implications for investments in Nigeria.

If Africa’s wealthiest man, with his extensive resources and influence, can face such significant hurdles, it raises concerns about the security and attractiveness of Nigeria’s investment climate for other entrepreneurs and foreign investors.

Dangote’s experiences suggest that even the most prominent businesses are not immune to regulatory pressures and political dynamics. This uncertainty could deter potential investors who might fear similar treatment, thereby affecting the country’s economic growth and development.

This will further compound the country’s economic challenges, especially at a time when the West African nation has seen a mass exodus of multinationals.

Although most of these exits were driven by a chronic shortage of foreign exchange and a sharp decline in the value of the local naira currency, a volatile economic landscape and a lack of investor confidence could further exacerbate the issue, thereby hindering foreign as well as local investment into the country.