Until 2022, details of the acquisition of Kenya’s Fidelity Commercial Bank were kept a secret. All that people knew was that the transaction helped prevent the collapse of the bank owned by Sultan Khimji.

The story starts like this: In 2016, several small banks in Kenya were experiencing a worsening liquidity crisis that led to the collapse of Dubai Bank, Chase Bank, and Imperial Bank. When Fidelity Commercial Bank started showing some strains, the owners-initiated negotiations with SBM Holdings, a Mauritian bank, to come to its rescue.

The negotiations ended in SBM purchasing the bank at a token price of $1. But Khamji maintains that that was not the agreement, and that SBM has reneged on its promise to pay an additional value that would reflect the value of the bank.

Was he cheated? That is a question that only a Kenyan court would find an answer to at this point. The owners of Fidelity Commercial Banks allege the involvement of the Central Bank of Kenya (CBK) in what they term as a serious and complex fraud scheme.

CBK says they only came in as a regulator to help save the bank, but Khamji argues that he was arm-twisted to sell his bank at the value of tomatoes.

Arguments and counterarguments

On July 31, a Kenyan court ruled that SMB Holdings will not pay a $19.2 million security deposit in the case challenging its controversial acquisition of FCBL in 2017 at $1 (KES130). Khimji wanted the High Court in Nairobi to order SBM to set aside the funds pending the determination of the suit.

Khimji argued in court that SBM Holdings could exit the Kenyan market before a ruling on the case. However, Justice Alfred Mabeya said there is no “evidence that the defendants will dispose of their assets in Kenya.”

“I find that the plaintiff’s apprehension is not enough to invoke the Court’s draconian discretion to order the giving of security,” Justice Mabeya said.

The controversial transaction was part of efforts to save FCBL, which could have been the fourth lender to fold in months in 2017. The collapse of Dubai Bank, Imperial Bank and Chase Bank eroded the confidence in small lenders.

This led to the meagre $1 price. According to court documents, the plaintiffs claim that SBM has failed to make any payments to the Khimji group, violating their agreement. They maintain that in a deal brokered by CBK, the Mauritian lender was to pay more after the deal.

It is the failure of SBM to honour the alleged agreement that led to the court case, five years after the acquisition. Interestingly, SBM has not disputed the existence of the agreement, and has been pushing consultations and arbitration to help resolve the matter.

In 2022, Khimji went to court to cancel the 2017 acquisition and compel SBM to pay $19.2 million as the company’s value as of December 2016. He also wanted SBM to pay profits accrued from the sale of the bank and damages compounded at 12% annually from January 2017.

FCBL said SBM inflated operational costs and provisions for bad loans to arrive at a negative valuation. In court filings, SBM defended the transaction, saying the bank injected $11.1 million (KES1.45 billion) into the cash-strapped lender to turn it around.

Khimji claimed in court documents that he was “misrepresented and coerced” into the deal by the Central Bank of Kenya (CBK) as part of a rescue plan. He said the directors were threatened with regulatory sanctions, criminal charges and closure.

Last year, CBK wanted the judge to strike then off the case, an application the court dismissed. FCBL said that the CBK, banking sector regulator, played a crucial role in brokering the deal between SBM Holdings and Fidelity Bank.

SBM also wanted the judge to refer the case to arbitration per a clause in their agreement with FCBL. However, Justice Mabeya declined, saying suspending the matter would violate Khimji’s rights to prosecute his case, which has raised alleged complex and serious fraud.

“The nature of the allegations vis a vis the prayers made oust the jurisdiction of arbitration as the alleged fraud is complex and serious,” the judge said.

“From the foregoing, it is clear that it has been demonstrated that there is a close fit between the allegations made and the prayers sought in the plaint.”

Beyond the case

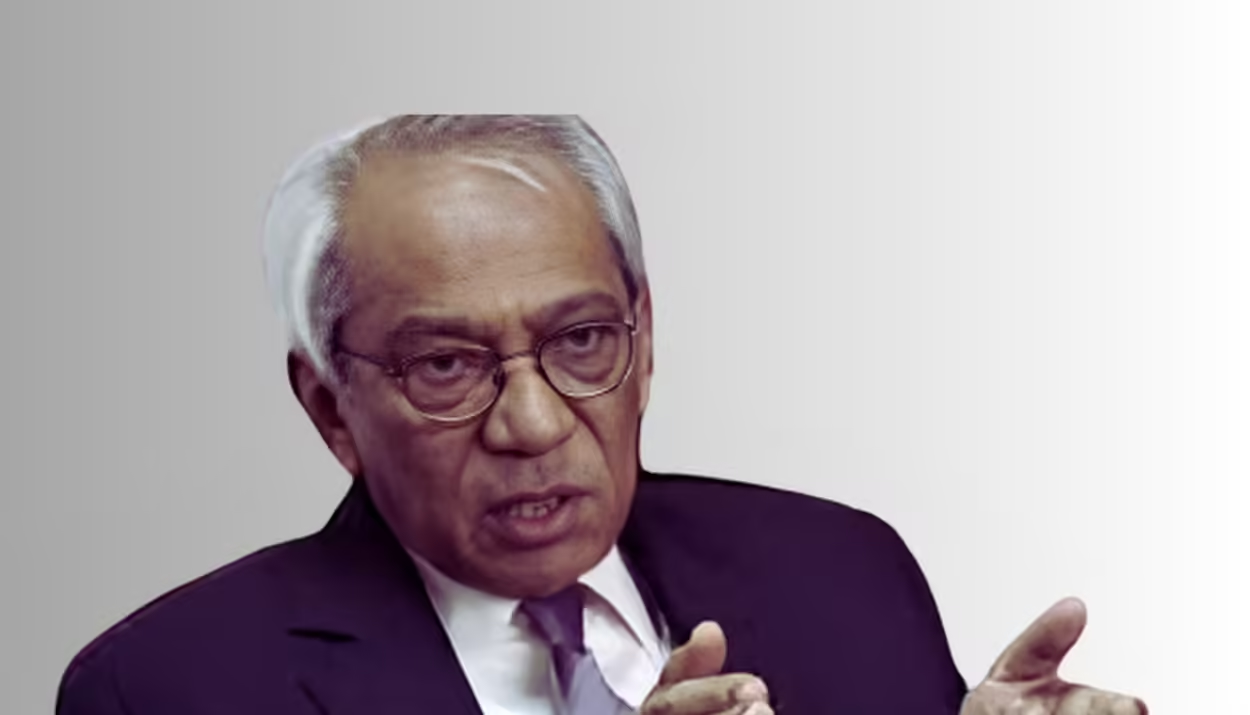

Beyond the matter before the high court there is not much details on Khimji, his family or other business holdings. But he has served in several boards including Jubilee Holdings, a Kenyan-based insurer with operations in Uganda and Tanzania.

FCBL was founded in 1980s, catering mostly for Asian community traders and manufacturers in Kenya. Its struggles in 2016 mirrored the challenges that most small lenders in Kenya were struggling with at the time.

Unfortunately, his dream to save its most prized asset ended in the legal corridors with the very people he brought in to help steady the ship disowning the agreement. Only time will tell whether the court will give him the $19.2 million he has sought or not.